– August 22, 2024 —

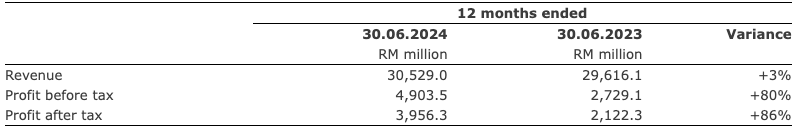

YTL Corporation Berhad recorded revenue of RM30,529.0 million (US$6,875.9 mn) for the 12 months ended 30 June 2024, increasing 3% compared to RM29,616.1 million (US$6,670.3 mn) for the 12 months ended 30 June 2023.

Profit before tax rose 80% to RM4,903.5 million (US$1,104.4 mn) this year compared to RM2,729.1 million (US$614.7 mn) last year, whilst profit after tax soared 86% to RM3,956.3 million (US$891.1 mn) for the 12 months under review compared to RM2,122.3 million (US$478.0 mn) last year.

The Board of Directors of YTL Corp declared an interim dividend of 4.5 sen per ordinary share, the book closure and payment dates for which are 13 November 2024 and 29 November 2024, respectively.

Executive Chairman, Tan Sri (Sir) Francis Yeoh Sock Ping, PSM, KBE, said, “The Group delivered excellent results for the 2024 financial year, with record-high revenue of RM30.5 billion and profit after tax of RM4.0 billion. The strong set of results was contributed by all business segments across the board, anchored by our utilities and cement divisions, with the construction, property, hotels and management services segments all turning in strong performances.

“The Group’s EBITDA (earnings before interest, tax, depreciation and amortisation) increased 37% to RM9.5 billion for the 12 months ended 30 June 2024 compared to RM6.9 billion last year.”

Comparison with Preceding Year

YTL POWER INTERNATIONAL BERHAD

YTL Power’s Full Year Profit After Tax Increases 73% to RM3.5 Billion

2nd Interim Dividend of 4.0 Sen per Share Declared, Annual Dividend Totals 7.0 Sen

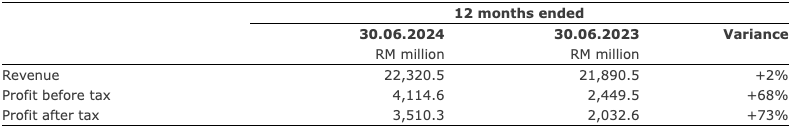

YTL Power recorded revenue of RM22,320.5 million for the 12 months ended 30 June 2024, increasing 2% compared to RM21,890.5 million for the previous 12 months ended 30 June 2023. Profit before tax grew 68% to RM4,114.6 million for the 12 months under review compared to RM2,449.5 million last year, whilst profit after tax rose 73% to RM3,510.3 million this year over RM2,032.6 million last year.

The Board of Directors of YTL Power declared a second interim dividend of 4.0 sen per ordinary share in respect of the financial year ended 30 June 2024, the book closure and payment dates for which are 13 November 2024 and 29 November 2024, respectively. Combined with the first interim dividend of 3.0 sen per ordinary share declared last quarter, this amounts to a total dividend of 7.0 sen per ordinary share in respect of the 2024 financial year.

Tan Sri (Sir) Francis Yeoh Sock Ping, Executive Chairman of YTL Power, said, “The Group achieved outstanding results for the year, contributed primarily by better profit before tax recorded in the power generation segment in Singapore as a result of better margins and lower interest expenses following early loan repayments.

“Improved performance of the water and sewerage segment in the UK was driven mainly by newly secured contracts in the non-household retail market and the price increase allowed by the industry regulator, whilst in the telecommunications segment, improved performance was achieved due to higher project revenue.”

EBITDA (earnings before interest, tax, depreciation and amortisation) for the 12 months ended 30 June 2024 increased 36% to RM7.2 billion, compared to RM5.3 billion last year.

Comparison with Preceding Year

MALAYAN CEMENT BERHAD

Malayan Cement’s Full-Year Profit After Tax Rises 169% to RM429 Million

2nd Interim Dividend of 6.0 Sen per Share Declared, Annual Dividend Totals 10.0 Sen

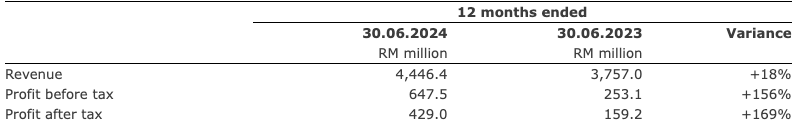

Malayan Cement’s revenue increased 18% to RM4,446.4 million for the 12 months ended 30 June 2024 compared to RM3,757.0 million for the 12 months ended 30 June 2023.

Profit before tax increased by 156% to RM647.5 million for the 12 months under review compared to RM253.1 million last year, whilst profit after tax rose 169% to RM429.0 million this year over RM159.2 million last year.

The Board of Directors of Malayan Cement declared a second interim dividend of 6.0 sen per ordinary share in respect of the financial year ended 30 June 2024, the book closure and payment dates for which are 30 October 2024 and 15 November 2024, respectively. Combined with the first interim dividend of 4.0 sen per ordinary share declared last quarter, this amounts to a total dividend of 10.0 sen per ordinary share in respect of the 2024 financial year.

Tan Sri (Sir) Francis Yeoh Sock Ping, Executive Chairman of Malayan Cement, said, “Malayan Cement achieved higher revenue this year due mainly to the stabilisation of the selling price for both domestic cement and ready-mixed concrete, in addition to continued improvements in operational efficiencies. Profit before tax for the 2024 financial year rose in tandem with the higher revenue, coupled with the moderation in coal prices”.

EBITDA (earnings before interest, tax, depreciation and amortisation) increased 52% to RM1,093.0 million for the 12 months ended 30 June 2024, compared to RM718.8 million last year.

Comparison with Preceding Year

Also view the individual reports below:

YTL CORPORATION BERHAD

YTL POWER INTERNATIONAL

MALAYAN CEMENT BERHAD

Release ID: 89139126

Should you detect any errors, issues, or discrepancies with the content contained within this press release, or if you need assistance with a press release takedown, we kindly request that you inform us immediately by contacting [email protected] (it is important to note that this email is the authorized channel for such matters, sending multiple emails to multiple addresses does not necessarily help expedite your request). Our expert team will be available to promptly respond and take necessary steps within the next 8 hours to resolve any identified issues or guide you through the removal process. We value the trust placed in us by our readers and remain dedicated to providing accurate and reliable information.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66cc5c5f6034477786fbd951023682c2&url=https%3A%2F%2Fmarkets.businessinsider.com%2Fnews%2Fstocks%2Fytl-corp-s-full-year-profit-after-tax-soars-86-to-rm4-0-billion-us-891-1-million-1033721273&c=12883195612370403233&mkt=en-us

Author :

Publish date : 2024-08-25 23:16:00

Copyright for syndicated content belongs to the linked Source.