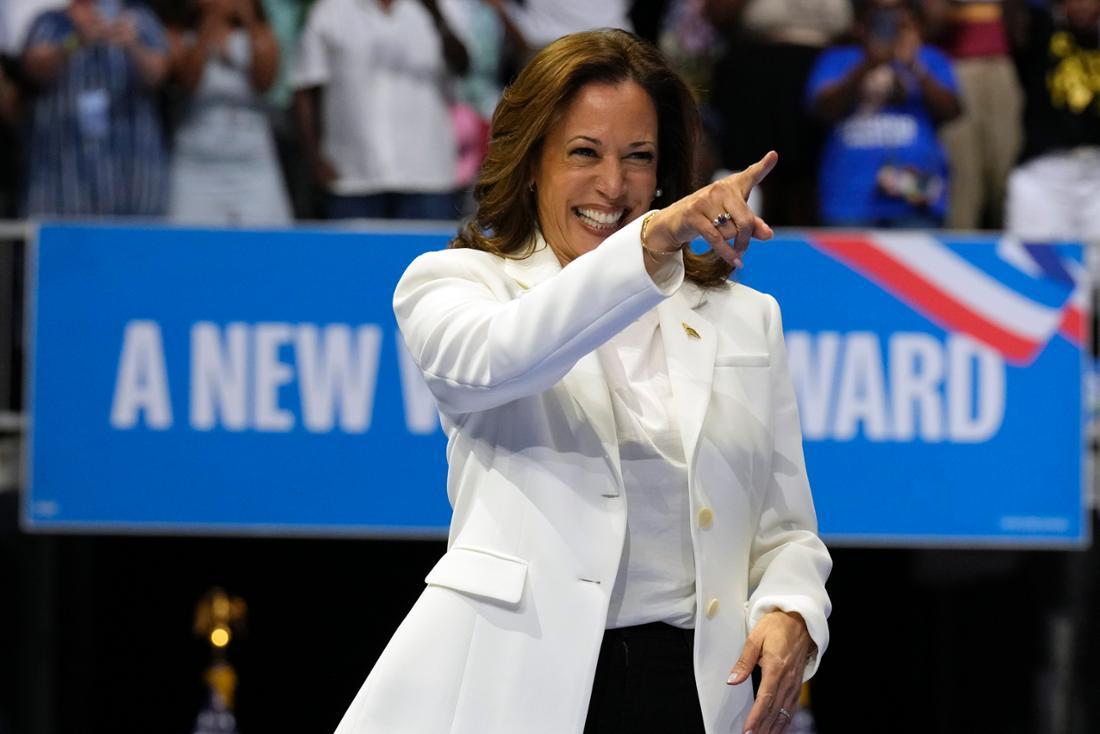

In a move aimed at bolstering small businesses across the country, Vice President Kamala Harris is set to propose a tax break of up to $50,000 as part of her economic plan. The proposed incentive, detailed in a report by USA TODAY, underscores the administration’s commitment to supporting the backbone of the American economy. Read on to learn more about how this initiative could impact small business owners nationwide.

Table of Contents

- Harriss Economic Plan Includes Significant Tax Break for Small Businesses

- Impact of $50K Tax Break on Small Business Growth and Sustainability

- Recommendations for Small Business Owners on Utilizing Tax Break to Maximize Benefits

- Q&A

- Insights and Conclusions

Harriss Economic Plan Includes Significant Tax Break for Small Businesses

As part of her comprehensive economic plan, Senator Harris is set to propose a $50,000 tax break for small businesses across the country. This move aims to provide much-needed relief to struggling entrepreneurs and stimulate growth in the small business sector.

The tax break is expected to benefit a wide range of small businesses, from mom-and-pop shops to tech startups. By easing the burden of taxes, Harris hopes to encourage entrepreneurship, job creation, and innovation in the economy. This initiative underscores her commitment to supporting small businesses as the backbone of the American economy.

Impact of $50K Tax Break on Small Business Growth and Sustainability

The proposed $50,000 tax break for small businesses, part of Sen. Harris’s economic plan, could have a significant impact on the growth and sustainability of these enterprises. By allowing small businesses to keep more of their revenue, they can reinvest in their operations, hire more employees, and expand their reach. This tax break could provide a much-needed financial boost to small businesses struggling to stay afloat amidst economic challenges.

In addition to stimulating growth, the $50,000 tax break could also improve the overall sustainability of small businesses. With extra funds available, small business owners can better weather unexpected expenses, invest in sustainability initiatives, and position themselves for long-term success. This tax break has the potential to not only benefit individual businesses but also contribute to the overall economic health of communities across the country.

Recommendations for Small Business Owners on Utilizing Tax Break to Maximize Benefits

Small business owners have a unique opportunity to take advantage of the proposed $50,000 tax break as part of the economic plan put forth by Harris. This break could provide a significant financial boost to businesses looking to invest, expand, or simply weather the economic uncertainty facing many industries. By carefully considering how to utilize this tax break, small business owners can maximize its benefits to help their businesses thrive.

Some recommendations for small business owners on utilizing this tax break include:

- Reinvesting the savings back into the business for growth and expansion

- Investing in technology upgrades or improvements to increase efficiency

- Consulting with a tax professional to ensure the tax break is being utilized effectively and legally

Q&A

Q: What is Kamala Harris proposing in her economic plan for small businesses?

A: Harris is proposing a $50,000 tax break for small businesses as part of her economic plan.

Q: Why is Harris advocating for this tax break?

A: Harris believes that small businesses are the backbone of the economy and need support to thrive and grow.

Q: How will this tax break benefit small businesses?

A: The tax break will provide much-needed relief to small businesses, allowing them to reinvest in their companies, hire more employees, and expand their operations.

Q: How does Harris plan to pay for this tax break?

A: Harris has outlined plans to repeal the Trump tax cuts for the top 1% of earners in order to fund the tax break for small businesses.

Q: What are the potential implications of Harris’s proposal?

A: Critics argue that repealing the Trump tax cuts could have negative consequences for the economy, while supporters believe that the tax break for small businesses will stimulate growth and create jobs.

Insights and Conclusions

Harris’ proposed $50,000 tax break for small businesses is set to be a game-changer in revitalizing the economy post-pandemic. As the plan continues to gain momentum, small business owners can look forward to much-needed relief and support from the government. Stay tuned for further updates on this developing economic initiative.