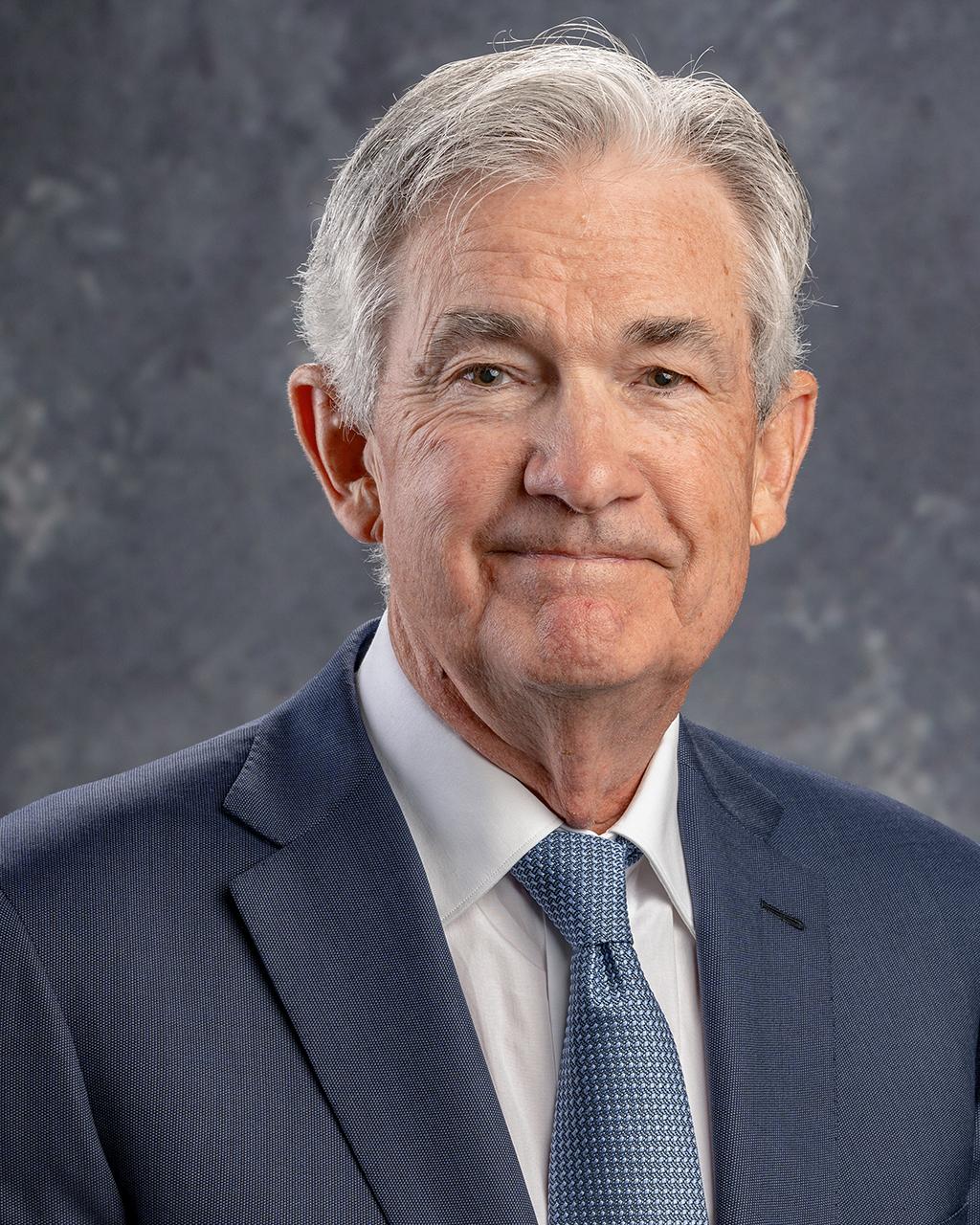

Federal Reserve Chair Jerome Powell has signaled a potential shift in monetary policy as he expressed “growing confidence” that inflation may be cooling. In a recent speech, Powell hinted at the possibility of more rate cuts in an effort to sustain the economic expansion. This development has sparked speculation and debate among analysts and investors about the future direction of the US economy. Let’s delve deeper into Powell’s remarks and their implications for the financial landscape in this detailed analysis.

Table of Contents

- Fed Chair Powells Optimism Regarding Cooling Inflation

- Potential for Further Rate Cuts to Sustain Economic Growth

- Risks and Challenges Amidst Powells Confidence in the Economy

- Q&A

- The Conclusion

Fed Chair Powells Optimism Regarding Cooling Inflation

Federal Reserve Chair Jerome Powell expressed optimism about the cooling inflation rate during a recent press conference. Powell stated that he has “growing confidence” that inflation is starting to slow down, which could potentially lead to more rate cuts in the future. This news comes as a relief to many investors and policymakers who have been closely monitoring the inflation rate in recent months.

Powell’s positive outlook on inflation is a sign that the Federal Reserve is actively working to stabilize the economy and ensure sustainable growth. The potential for more rate cuts in the future indicates that the Fed is prepared to take necessary action to prevent inflation from spiraling out of control. Powell’s comments have sparked hope that the economy is on the right track and that measures are being taken to address any potential economic challenges.

Potential for Further Rate Cuts to Sustain Economic Growth

During a recent interview, Federal Reserve Chair Jerome Powell expressed his confidence in the current state of inflation, stating that it was beginning to cool. This has led to speculation that further rate cuts could be on the horizon to sustain economic growth. Powell highlighted the Fed’s commitment to supporting the economy and ensuring a strong labor market, indicating that additional rate cuts may be a necessary tool to achieve these goals.

Powell’s comments have sparked anticipation among investors and economists, with many closely monitoring the Fed’s next moves. The possibility of more rate cuts has the potential to stimulate borrowing and spending, ultimately boosting economic growth. While the exact timing and extent of these cuts remain uncertain, Powell’s remarks have raised hopes for continued support from the Fed in the face of economic challenges.

Risks and Challenges Amidst Powells Confidence in the Economy

Despite Federal Reserve Chairman Jerome Powell expressing “growing confidence” in the economy, there are still risks and challenges that could impact the financial landscape. While Powell remains optimistic about inflation cooling, there is a possibility of more rate cuts in the future to bolster the economy.

Amidst Powell’s confidence, here are some of the key risks and challenges that could pose a threat to the economy:

- Trade tensions: Ongoing trade disputes between major economies could lead to increased volatility in the markets.

- Geopolitical uncertainty: Unforeseen events such as political instability or conflicts could disrupt global economic stability.

- Slowing global growth: The slowdown in key global economies could impact the US economy through reduced demand for exports.

Q&A

Q: Who is Jerome Powell and what is his role?

A: Jerome Powell is the current Chair of the Federal Reserve, the central bank of the United States.

Q: What did Powell say about inflation and interest rates?

A: Powell stated that there is “growing confidence” that inflation is cooling, and also suggested that further rate cuts are possible in the future.

Q: Why is Powell’s statement significant?

A: Powell’s comments indicate that the Federal Reserve may continue to take action to stimulate economic growth in the face of slowing global growth and ongoing trade tensions.

Q: How have financial markets reacted to Powell’s remarks?

A: Following Powell’s statements, financial markets have speculated on the possibility of further rate cuts, leading to increased volatility in stock and bond markets.

Q: What factors are contributing to the Fed’s decision-making process?

A: The Federal Reserve is closely monitoring economic indicators such as inflation, job growth, and consumer spending in order to determine the most appropriate monetary policy actions.

Q: How might Powell’s remarks impact the average consumer?

A: If the Federal Reserve continues to cut interest rates, it could potentially lower borrowing costs for consumers, making mortgages, car loans, and credit card debt more affordable.

The Conclusion

Fed Chair Jerome Powell’s remarks signal a possible shift in monetary policy as he expresses a growing confidence that inflation may be cooling. With the door left open for more rate cuts, the Federal Reserve continues to closely monitor economic indicators to ensure stability in the financial markets. As the global economic landscape continues to evolve, Powell’s cautious optimism serves as a beacon of stability amidst uncertainty. Stay tuned for further developments as the Federal Reserve navigates these unprecedented times. Thank you for reading.