35 strangers fraudulently added to California woman’s Chase credit card as authorized users

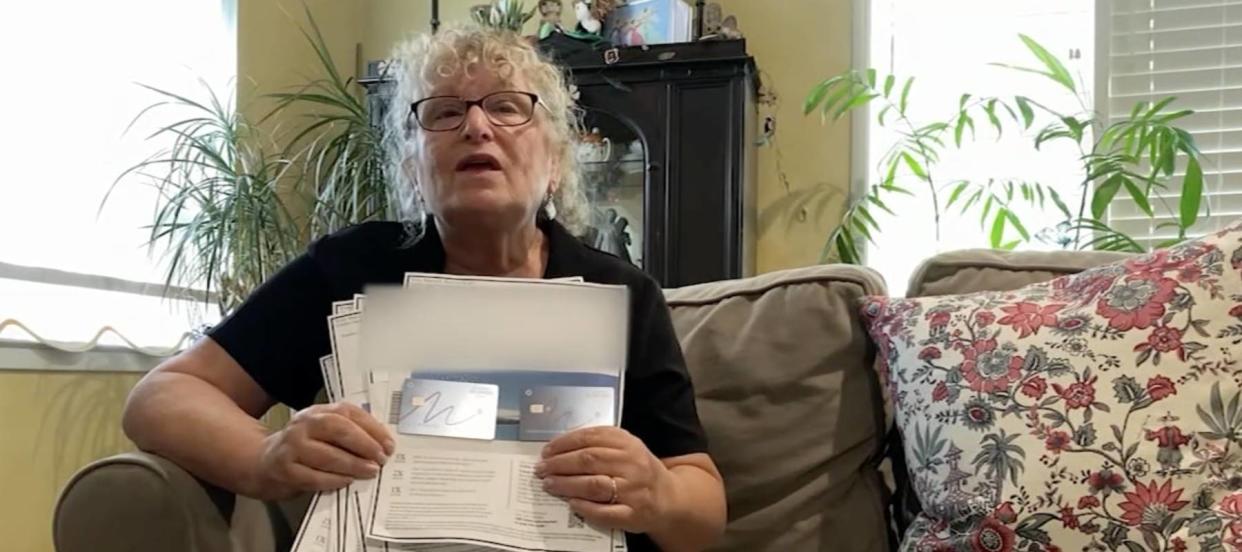

When Jodi Hayes went on a cruise in August, she didn’t expect to discover that 35 strangers were added onto her Marriott Bonvoy Chase Bank credit card account while she was away.

But that’s exactly what happened to the Walnut Creek, California, woman: 35 credit cards, all in other people’s names, started to arrive in her mailbox while she was on vacation — each with the ability to charge up to $19,000 on her card or get $950 cash back.

Don’t miss

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here’s how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

These 5 magic money moves will boost you up America’s net worth ladder in 2024 — and you can complete each step within minutes. Here’s how

“I know I have good credit, but I’ve never seen anything like this ever,” Hayes told ABC7 News — San Francisco. “This fiasco ruined the end of our vacation.”

Hayes immediately contacted Chase from the cruise ship after an email from the U.S. Postal Service Informed Delivery program alerted her to the issue, but she was left frustrated by the response.

“They were just very basic — ‘oh, okay yeah. Maybe it’s some computer glitch. We’ll stop it,’” she said.

Here’s what happened next — and how Hayes’ calm and collected response is a blueprint for anyone who is contending with the aftermath of identity theft.

The $16.4 billion problem of identity theft

While Hayes and her husband were still enjoying their vacation, she was alerted to the credit card issue when she checked her email and noticed a message from the U.S. Postal Service Informed Delivery program, which showed her all the names and cards bound for her home.

From the cruise ship, Hayes contacted Chase who reportedly attributed it to a glitch in the system and stopped the cards from being activated.

Their fraud department later followed up, but Hayes said they didn’t do much except make a note in their system and issue her a new account number. “With no explanation just, ‘we’ll take care of it, we’ll send you a new card, a new number,’” she said. “I wanted them to say, ‘we’ll investigate it.’”

In today’s digital world, data breaches involving personal identifiable information (PII) is becoming an inevitability.

In August 2024, USA Today reported that data broker, National Public Data, had more than two billion records stolen from their servers, including names, addresses, and Social Security numbers.

Data breaches aren’t the only way criminals can potentially access your information. Federal officials say some of the most common ways your personal information could end up in the wrong hands includes stolen wallets or purses, tax returns or bank statements plucked from the trash, information stolen through public Wi-Fi, or via “phishing” emails or texts.

When that information gets into the hands of bad-faith actors, it can quickly turn into a crime that only gets discovered after the fact.

According to the Department of Justice (DOJ), 23.9 million people were the victims of identity theft in 2021 alone, with more than half of them accounting for a total loss of $16.4 billion.

What’s worse, many of the victims didn’t find out until it was too late. In 2021, the DOJ reported that more than 25% of victims found out their personal information was breached only after a new account was already opened in their name.

In Hayes’ situation, Chase issued an emailed statement to ABC7 News: “We monitor customer accounts for suspicious activity and promptly contact them if something unusual is detected. In this instance, our vigilant customer alerted us first. We closed the unauthorized cards, issued a new account and card, and apologized for the inconvenience caused during her vacation.”

Read more: Rich, young Americans are ditching the stormy stock market — here are the alternative assets they’re banking on instead

How to recover after an identity theft attempt

Even before the attempted breach on Hayes’ account, she was doing everything in her power to minimize her risk of identity fraud, including using Informed Delivery by USPS to preview her incoming mail and using a lock box on her residential mailbox.

Her quick response halted even more potential damage to her personal information and credit file.

To further minimize the chances of becoming a victim of identity theft, authorities say you should check your credit report at least once per year.

Everyone is entitled to a free copy of their report from all three credit bureaus at annualcreditreport.com.

To go a step further, the Consumer Financial Protection Bureau recommends putting a security freeze on your credit file at each of the agencies to prevent anyone from opening a new credit account in your name.

If you realize someone is attempting to commit identity theft using your information, the first step is to contact your financial institution where the fraud is happening.

Reporting the issue and locking down your credit card, debit card, or bank account from further attacks can help you recover your information faster.

The Federal Trade Commission (FTC) offers a tool that can help you report identity theft and walk you through a recovery plan. Consumers can find that tool at identitytheft.gov.

As for Hayes, it’s not clear if the fraudsters were planning an attempt to steal her mail, but the United States Postal Inspection Service told ABC7 News that she did everything correctly.

What to read next

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66f2b4fbdd5f44e38442a6db2bcef4e6&url=https%3A%2F%2Fwww.aol.com%2Ffinance%2F35-strangers-fraudulently-added-california-112900970.html&c=8180799324098175579&mkt=en-us

Author :

Publish date : 2024-09-24 00:29:00

Copyright for syndicated content belongs to the linked Source.