New U.S. Census Bureau data from the 2023 American Community Survey revealed that New Hampshire’s renters continue to be cost-burdened by housing expenses. State-level data show renters in New Hampshire have lower median incomes and are more likely to be burdened by housing costs than homeowners. Renters are more likely to be younger, to live in older housing units than owners, to be Granite Staters of color, and to have fewer years of formal education. Trends since 2021 suggest that renter median incomes are growing at slower rates than homeowner incomes, which may further contribute to income inequality between Granite Staters who own their homes compared to those who do not.

New Hampshire Renters Cost-Burdened by Housing Expenses

In 2023, the estimated median income for households that owned their home was $114,853. Renters’ median household income that same year, however, was estimated to be $53,816, less than half of the median income of owner households. During the recovery from the COVID-19 pandemic, homeowner median household incomes increased between 2021 and 2023 with estimated incomes rising approximately 11 percent. Homeowner median income also increased about 20.6 percent since 2019, before the pandemic reached New Hampshire, unadjusted for inflation. Since 2019, renter household incomes also increased, rising an estimated 19.4 percent. However, renter household incomes in 2023 were statistically unchanged from 2021, even without adjusting for inflation, and declined by an estimated $2,486 between 2022 and 2023.

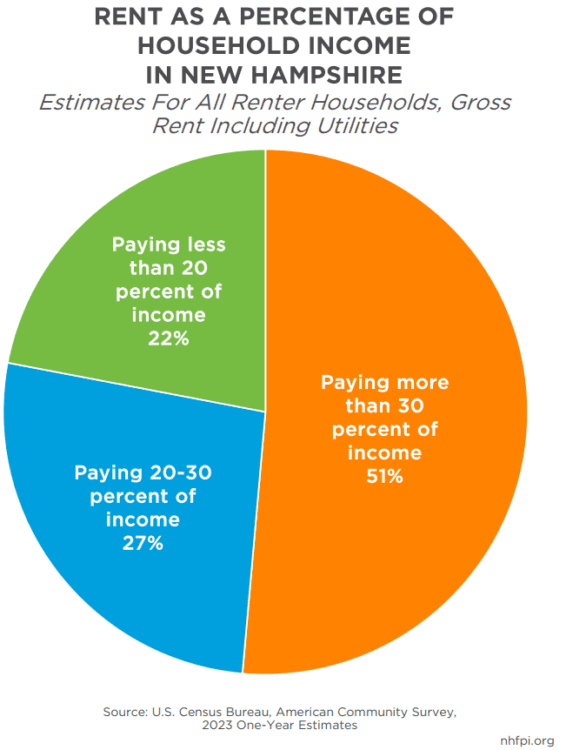

Lower incomes increase the likelihood of being cost-burdened by housing costs, including rent and utilities. Cost-burdened is a term the U.S. Department of Housing and Urban Development uses to describe households that pay more than 30 percent of their income toward housing. In 2023, approximately 51 percent of renters met the criteria of being housing cost-burdened compared to about 28 percent of owner households paying a mortgage and about 20 percent of owner households without a mortgage.

Indepth Your Inbox

Get unbiased nonprofit watchdog news sent directly to your inbox.

Characteristics of Homeowner and Rental Households

Renters are disproportionately more likely to be Granite Staters of color than homeowners, with 83.2 percent of renting households identifying as white and non-Hispanic in 2023 compared to 91.6 percent of homeowners. White, non-Hispanic New Hampshire residents constitute approximately 88.5 percent of the entire Granite State population in 2023.

New Hampshire renters are also more likely to be younger, with approximately 30 percent of renters under 35 years old, compared to just 9.4 percent of homeowners. In 2023, the largest percentage of homeowning householders ranged between the ages of 55 to 74 years old, accounting for approximately 45 percent of homeowners households, but only about 28 percent of New Hampshire’s total population. Around 76 percent of homeowners have at least some postsecondary education, while approximately 61 percent of renters completed coursework beyond high school. The disparity in age and educational attainment between owners and renters may reflect increasing single-family house sale prices, for which the statewide median sale price rose 66 percent between 2018 and 2023. These increased prices likely require higher downpayments, which could be cost prohibitive for younger Granite Staters, as well as workers in lower-paying professions that do not require postsecondary training. As of August 2024, the median sale price of a single-family house in New Hampshire was $535,000.

Renter households are also more likely to live in older housing units, with approximately 58 percent of renters living in units built in 1979 or earlier compared to 48 percent of owners. Housing units are one component of the social determinants of health, which encompass both the societal and the environmental conditions that contribute to the health and well-being of individuals and families. Older homes may be more likely to be built using inefficient methods and materials that result in higher energy costs, and to have environmental toxins, such as lead paint, that can contribute to long-term health problems.

Implications of Income Inequality Among Renters

A limited supply of housing units in New Hampshire is contributing to both higher rental costs and increased sale prices for single-family houses across the state, making purchasing a home, and associated wealth-building opportunities, more difficult to access for those who currently rent. Recent trends suggest that median household incomes may also be growing at faster rates for homeowners since 2021 than for renters. Renting households may face difficulty meeting their living expenses due to a variety of factors including a higher likelihood of having lower incomes, being housing cost-burdened, and having less postsecondary educational training that may limit annual earnings growth. A 66 percent rise in eviction writ filings between 2020 and 2023 and a 52 percent increase in the number of unhoused Granite Staters from January 2022 to January 2023 may reflect the financial difficulties facing New Hampshire’s renters.

As a larger proportion of homeowners are older and identify as white and non-Hispanic compared to the overall New Hampshire population, the State may witness more wealth inequality that negatively impacts Granite Staters of color and younger residents. Furthermore, the higher likelihood of renters living in older homes creates risks of exposure to environmental toxins that can impact the overall health of New Hampshire’s renting population.

Continued investment in programs supporting construction of additional housing units and considerations of zoning law reform may help ensure increased availability of housing that can reduce housing costs for all Granite Staters. Access to housing for individuals with low incomes may also be bolstered through voucher programs that assist with both renting, and possible purchase, of homes. Having safe, stable, and affordable housing for all Granite Staters will benefit the entire state, helping residents enhance their physical, mental, and financial wellbeing and become better able to contribute to thriving New Hampshire communities.

– Nicole Heller, Senior Policy Analyst

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66f203956d624c178451b3683b6a9844&url=https%3A%2F%2Findepthnh.org%2F2024%2F09%2F23%2Fnew-hampshire-renters-cost-burdened-by-housing-expenses%2F&c=3974370798111017480&mkt=en-us

Author :

Publish date : 2024-09-23 12:07:00

Copyright for syndicated content belongs to the linked Source.