For Rhode Island, the advent of a rate cut comes at a time when the unemployment rate has gone up while the labor market is seeing fewer jobs available for workers. Meanwhile, the housing market has registered record prices for homes amid elevated mortgage rates and limited supply of homes in the market.

Get Rhode Map

A weekday briefing from veteran Rhode Island reporters, focused on the things that matter most in the Ocean State.

Experts suggested that the Fed’s move would help stabilize the labor market in the state.

“We have seen some weakness, but we haven’t been seeing a whole lot of layoffs and hopefully this will continue to decrease the number of layoffs,” Lisa Murray, Citizens Bank’s Massachusetts president, told the Globe. “I think we got a little fat during the pandemic and that’s why we saw some of the activity that we’ve been seeing with layoffs. But I think people are going to continue to try to right-size their organizations for a much more measured economy going forward.”

Laurie White, the president of the Greater Providence Chamber of Commerce, told the Globe the Fed’s lowering of borrowing costs will help companies to source relatively cheaper capital to invest in their businesses.

“I think it could be euphemistically said hallelujah,” she said. “The reduction, the half-point reduction, is going to unleash additional capital expenditure activity.”

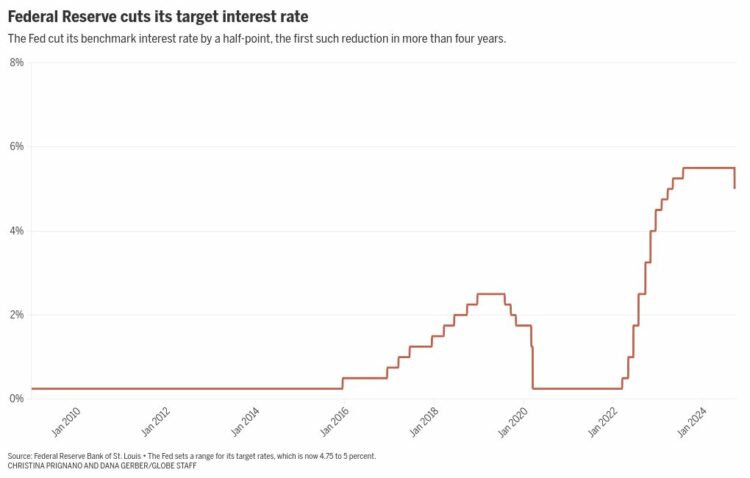

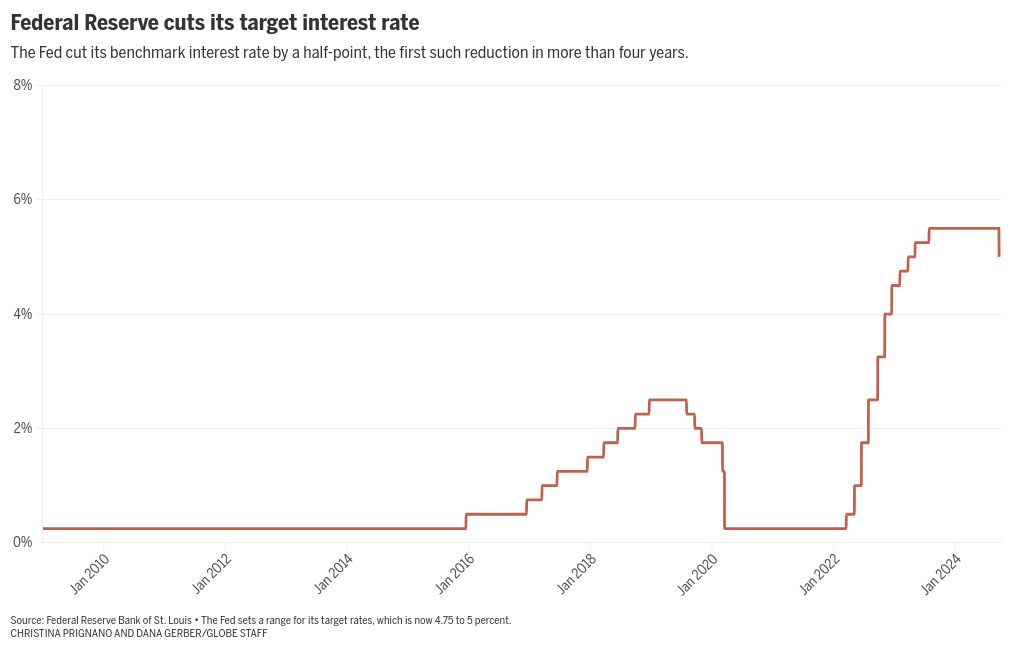

White described the Fed’s move as “aggressive” and anticipated more cuts over the coming months. She noted, however, how businesses react will be influenced by more than just what the Federal Reserve does, but also by the results of who will end up in the White House.

“I don’t think you’ll see anything, you know, truly, truly consequential from business in terms of making any moves until after the election in November, when it is determined what direction [of] the policy is,” White said.

One area of Rhode Island’s economy White said could be impacted by a drop in rates is the building sector, which could be helped by lower borrowing costs.

“The building and the construction industry is a very important sector to the Rhode Island economy,” she said. “There is a tremendous amount of pressure on homes, there is not…a lot of inventory. What we need is more inventory. But in order to get more inventory, you need to be able to borrow and build at rates that are competitive.”

John Marcantonio, the chief executive officer of the Rhode Island Builders Association, said he would wait and see how the rate cut impacts his members who represent the residential construction business in the state.

“When it was going up, the pace at which it went up, it certainly did affect, you know, housing,” Marcantonio said. “In many ways, how fast it comes down, the pace at which it comes down, where it would settle in, is going to be something we’re all going to have to sit back and watch and see how that effect happens. I would say I’m glad the Fed is finally cutting rates.”

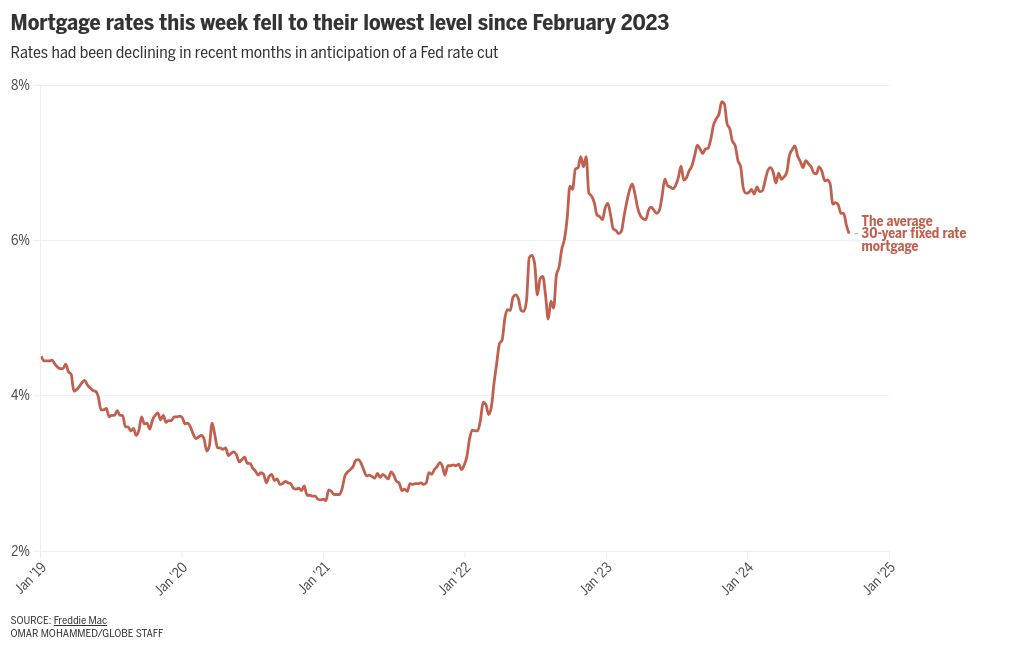

Limited inventory is a major concern for the housing market in Rhode Island. A rate cut could lead to lower mortgage rates, which will spur demand for homes in a state struggling to provide enough properties for prospective buyers, said Chris Whitten, president-elect of the Rhode Island Association of Realtors.

Interest rates on home loans had been dropping in recent weeks in anticipation of a quarter percentage point rate cut, he said, but a 50 basis point reduction would put added pressure on the Ocean State’s housing market.

On Thursday, Freddie Mac revealed that the 30-year fixed mortgage rate fell to a little over 6 percent, the lowest level it has hit since February 2023.

“For the Rhode Island housing market, which was already struggling with inventory,” he said, “I am going to see, I think, a lot more buyers getting in the market and therefore a lot more multiple offer situations and therefore the home values continuing to go up on their already record median high pace.”

In recent years, Rhode Island has lagged behind other states in the country in issuing new construction and building permits. An increase in local prospective homebuyers and from neighboring states would escalate competition and push up prices. Although lower borrowing costs may ease the cost of capital for builders, the sector would still face challenges to develop new homes.

“Even though it may be more advantageous for builders now, given the 50 basis points cut, it’s a matter of actually finding those opportunities and getting through the red tape that we have here in Rhode Island, at the local level, to build the inventory that we do need,” Whitten said.

This story has been updated with charts and additional context on mortgage rates

Omar Mohammed can be reached at omar.mohammed@globe.com. Follow him on Twitter (X) @shurufu.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66ed145fe4b546a38178af13b24058a8&url=https%3A%2F%2Fwww.bostonglobe.com%2F2024%2F09%2F19%2Fmetro%2Ffed-rate-cut-could-stabilize-rhode-island-labor-market%2F&c=11293594719261268176&mkt=en-us

Author :

Publish date : 2024-09-18 22:59:00

Copyright for syndicated content belongs to the linked Source.