In a welcome turn of events for homeowners and prospective buyers, lower mortgage rates are poised to inject a sense of normalcy into the turbulent housing market. As reported by USA TODAY, this promising development comes as a lifeline for many in the real estate industry who have been grappling with uncertainty and volatility. Let’s delve into how these reduced rates are expected to reshape the landscape of homebuying in the near future.

Table of Contents

- Lower mortgage rates stimulate housing market recovery

- Expert analysis on the impact of lower mortgage rates

- Strategies for homebuyers to take advantage of decreased rates

- Q&A

- The Way Forward

Lower mortgage rates stimulate housing market recovery

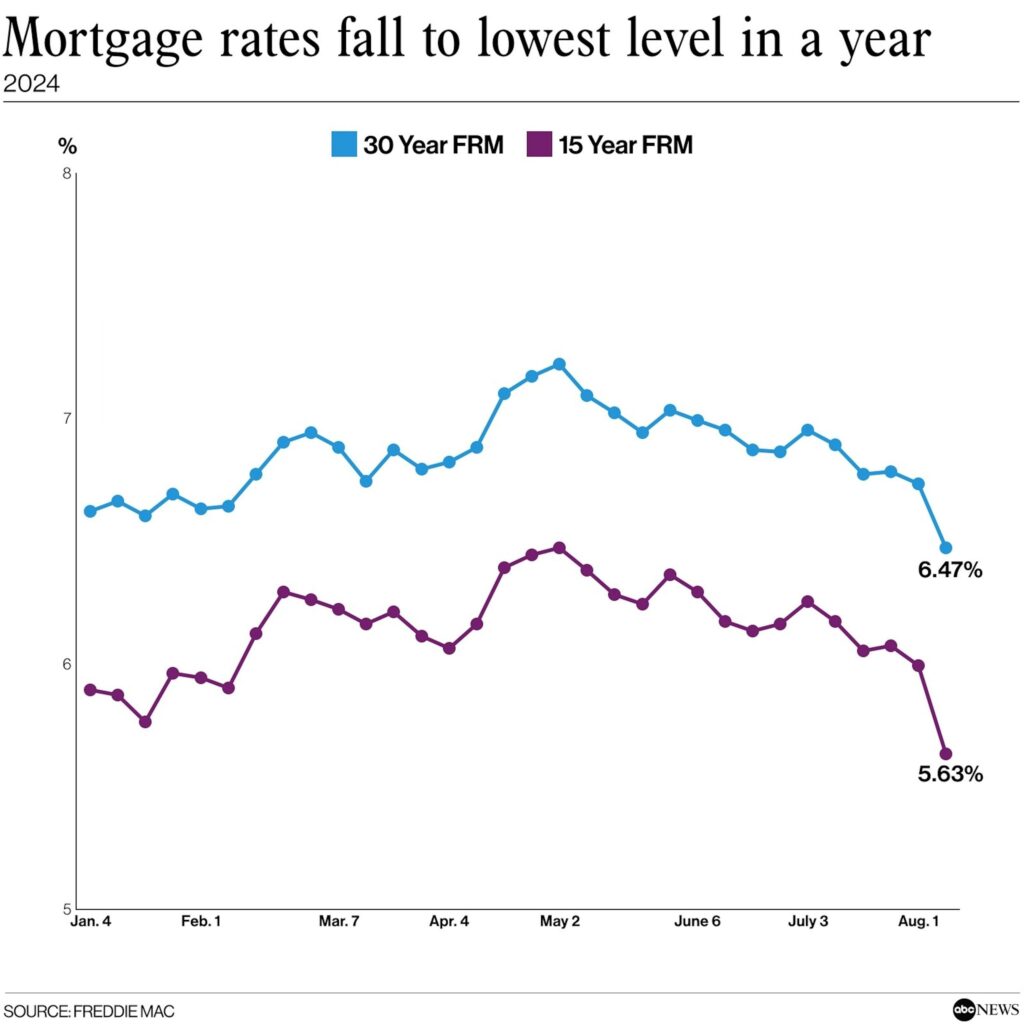

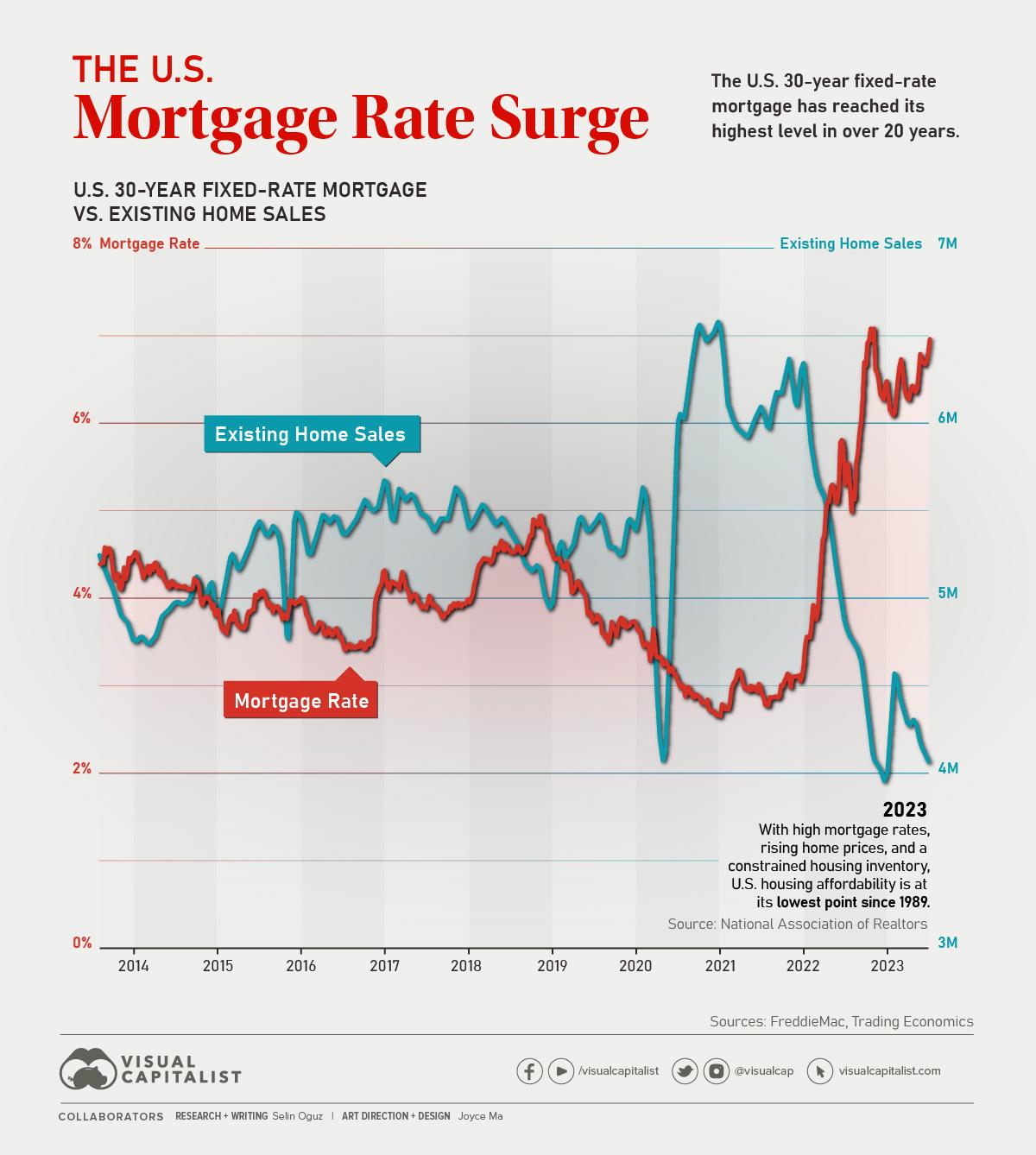

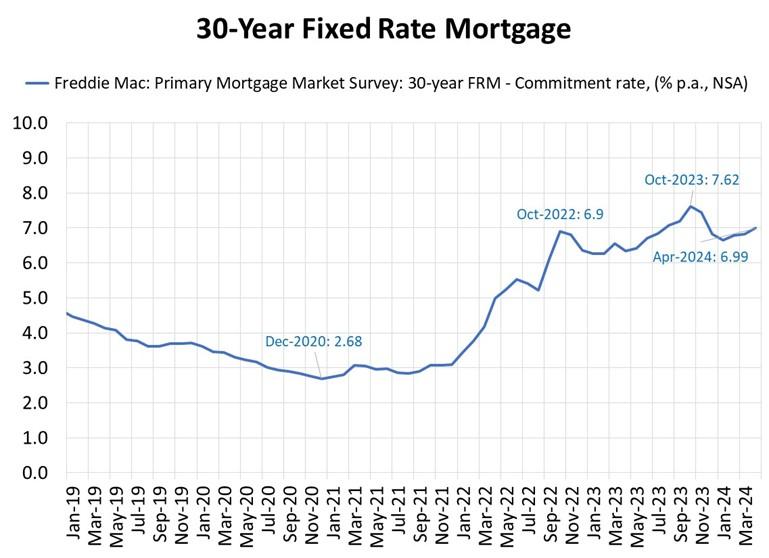

After months of uncertainty and stagnation, the housing market in the United States is finally showing signs of recovery thanks to lower mortgage rates. Homebuyers are rushing to take advantage of the historically low rates, leading to a surge in sales and a much-needed boost for the real estate industry. With more people able to afford homes, the market is experiencing a sense of normalcy that hasn’t been seen in years.

This shift in the housing market is not only benefiting buyers, but sellers as well. As demand for homes increases, sellers are finding that their properties are moving off the market faster and at more competitive prices. This positive momentum is expected to continue as long as the mortgage rates remain low, providing a glimmer of hope for a market that has been struggling to find its footing. The future is looking brighter for both buyers and sellers in the housing market.

Expert analysis on the impact of lower mortgage rates

Experts in the real estate industry are optimistic about the impact of lower mortgage rates on the housing market. With interest rates hitting record lows, potential homebuyers are expected to take advantage of the favorable conditions and enter the market. This surge in demand is predicted to bring some much-needed normalcy to a housing market that has been struggling in recent months.

According to industry analysts, lower mortgage rates will not only make homeownership more affordable for buyers, but they will also incentivize current homeowners to refinance their existing mortgages. This influx of activity is expected to stimulate the housing market and provide a boost to the overall economy. As a result, experts are forecasting a more stable and balanced real estate market in the coming months, with increased sales and a gradual recovery from the impact of the pandemic.

Strategies for homebuyers to take advantage of decreased rates

With mortgage rates hitting record lows, homebuyers have a prime opportunity to secure their dream home at a more affordable price. To take full advantage of these decreased rates, here are some strategies to consider:

- Act quickly: With rates fluctuating, it’s crucial to act fast when you find a rate that works for you.

- Get pre-approved: Getting pre-approved for a mortgage can give you a competitive edge in a hot market.

- Consider refinancing: If you already own a home, now may be the perfect time to refinance and save on your monthly payments.

By implementing these strategies, homebuyers can navigate the current housing market with confidence and make the most of the decreased mortgage rates available.

Q&A

Q: What impact are lower mortgage rates expected to have on the housing market?

A: Lower mortgage rates are expected to bring much-needed normalcy to the housing market by increasing affordability for homebuyers and potentially sparking more activity in the real estate sector.

Q: How have recent fluctuations in mortgage rates affected the housing market?

A: Recent fluctuations in mortgage rates have caused uncertainty and instability in the housing market, with potential homebuyers hesitant to make large financial commitments in such a volatile environment.

Q: What factors are contributing to the decrease in mortgage rates?

A: Several factors are contributing to the decrease in mortgage rates, including a more dovish stance from the Federal Reserve, concerns over the global economy, and geopolitical tensions that are driving investors towards safer investments like bonds.

Q: How are potential homebuyers responding to the lower mortgage rates?

A: Potential homebuyers are taking advantage of lower mortgage rates by exploring their options and considering purchasing a home sooner rather than later in order to lock in a favorable rate.

Q: What does this trend indicate for the future of the housing market?

A: This trend indicates a potential resurgence in the housing market, with increased interest from buyers and a more stable environment for sellers, ultimately leading to a more balanced and healthy real estate sector.

The Way Forward

the recent decrease in mortgage rates has the potential to have a significant impact on the housing market in the coming months. With more affordable borrowing options available to buyers, we may see an increase in home purchases and a return to a more stable and balanced market. As always, it will be important to continue monitoring these trends to see how they unfold and what implications they may have for both buyers and sellers. Stay tuned for more updates on this developing story.