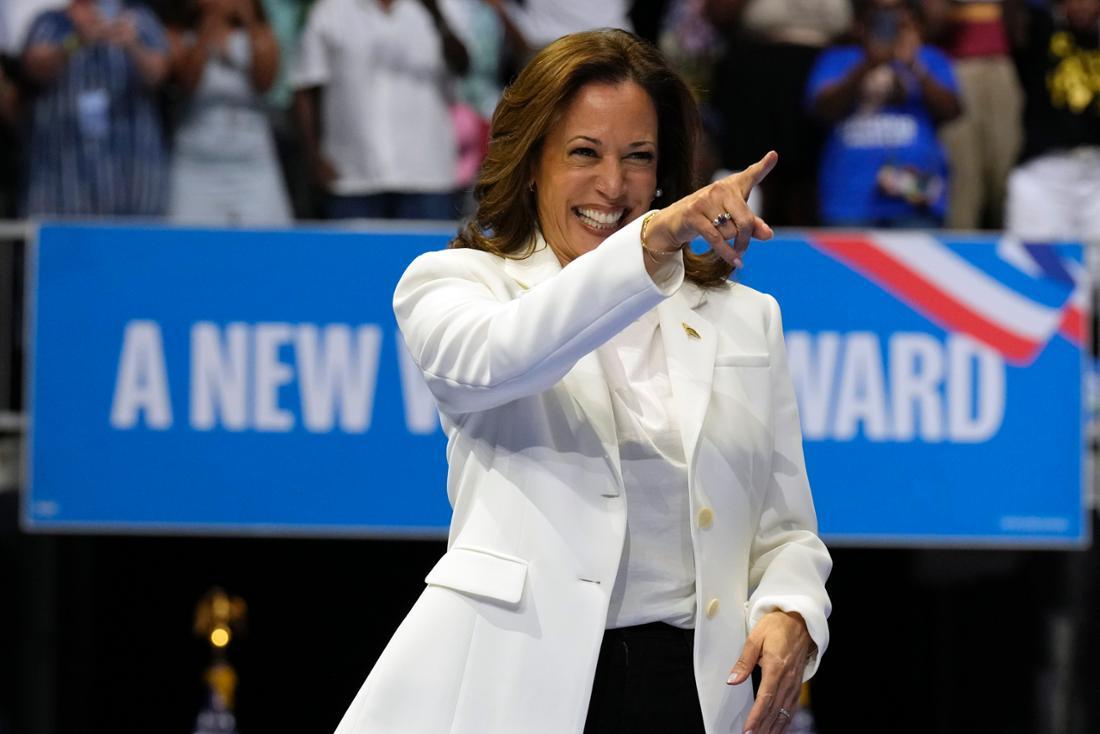

In a recent announcement that has sparked discussion among economists and political analysts, Vice President Kamala Harris has publicly diverged from President Joe Biden on the issue of capital-gains tax rates. This rare policy break between the two leaders comes as they navigate the complexities of tax reform and economic policy in the United States. USA TODAY takes a closer look at this significant development and its potential implications for the Biden administration’s agenda.

Table of Contents

- Harris takes a stand on capital-gains tax rate issue

- Implications of Harris policy break with Biden

- Analysis of potential impact on economy and stock market

- Recommendations for navigating potential changes in tax policy

- Q&A

- In Retrospect

Harris takes a stand on capital-gains tax rate issue

Senator Harris made a bold statement today by announcing her departure from President Biden on the issue of capital-gains tax rates. In a surprise move, Harris advocated for a higher tax rate on capital gains, diverging from Biden’s stance on the matter. This departure showcases Harris’s commitment to addressing income inequality and fairness in the tax system.

While some may view Harris’s stance as a break from the Democratic Party’s traditional policies on taxation, others see it as a refreshing approach to wealth distribution. Harris’s proposal includes raising the capital-gains tax rate for individuals earning over $1 million annually. This move is aligned with her campaign promises of economic equity and social justice. It remains to be seen how this decision will impact Harris’s political alignment and relationship with the Biden administration moving forward.

Implications of Harris policy break with Biden

Kamala Harris has caused quite a stir by announcing a rare policy break with President Biden on the capital-gains tax rate. The Vice President’s proposal to increase the tax rate on investment profits for the wealthiest Americans has drawn both praise and criticism from lawmakers and the public alike. This move signals a potential shift in the administration’s economic strategy and has left many wondering about the implications for future policy decisions.

The decision to break with Biden on the capital-gains tax rate underscores Harris’ commitment to addressing income inequality and ensuring that the wealthiest individuals pay their fair share. By proposing a higher tax rate on investment profits, the Vice President is sending a strong message about the administration’s priorities and willingness to challenge traditional economic policies. However, the move also raises questions about how this divergence in policy stance will affect the overall unity and effectiveness of the Biden-Harris administration moving forward.

Analysis of potential impact on economy and stock market

Upon Harris’s announcement of breaking with Biden on the capital-gains tax rate, analysts are closely monitoring the potential impact on the economy and stock market. The proposed increase in the capital-gains tax rate could have far-reaching implications on investors, businesses, and overall market stability.

Investors are contemplating their next moves as they assess how the proposed policy change could affect their portfolios. Businesses are strategizing on how to navigate potential tax increases and adjust their financial plans accordingly. Market volatility is expected as uncertainties surrounding the capital-gains tax rate linger.

Recommendations for navigating potential changes in tax policy

As tax policies continue to shift, it is crucial for individuals and businesses to stay informed and proactive in navigating these changes. To adapt to potential alterations in tax policy, consider the following recommendations:

- Stay Updated: Regularly monitor news outlets and updates from government sources to stay informed on proposed tax policy changes.

- Consult a Professional: Seek guidance from a tax professional or financial advisor to understand how potential changes may impact your specific situation.

- Review Investments: Evaluate your investment portfolio in light of potential changes to capital gains tax rates.

By staying informed and seeking expert advice, individuals and businesses can proactively navigate potential changes in tax policy and make informed decisions to manage their financial strategies effectively.

Q&A

Q: What policy stance has Vice President Kamala Harris recently taken in a departure from President Joe Biden’s position?

A: Vice President Kamala Harris has announced a rare policy break with President Joe Biden on the capital-gains tax rate.

Q: What specific aspect of the capital-gains tax rate does Harris differ from Biden on?

A: Harris has proposed a higher capital-gains tax rate for top earners, going against Biden’s current stance on the issue.

Q: How does Harris justify her differing position on the capital-gains tax rate?

A: Harris argues that raising the capital-gains tax rate for top earners is a way to help fund the administration’s economic agenda and address income inequality.

Q: What are some potential implications of Harris’ break with Biden on this policy issue?

A: Harris’ differing stance on the capital-gains tax rate could signal a shift in the administration’s approach to tax policy and potentially lead to debate and negotiation within the Democratic party.

Q: How have other political figures and experts responded to Harris’ announcement?

A: Some progressives have applauded Harris for her proposal, while others have expressed concerns about the impact of raising the capital-gains tax rate on the economy and investment. Experts are also weighing in on the potential effects of the policy change.

In Retrospect

In an unexpected move, Vice President Kamala Harris has broken ranks with President Joe Biden on the issue of the capital-gains tax rate. This rare policy divergence highlights the diverse perspectives within the administration and sets the stage for a potentially contentious debate. As the White House navigates this internal rift, the implications for the economy and the American people remain to be seen. Stay tuned for further developments on this evolving story. Thank you for reading USA TODAY.