DENVER (KKTV) – The Colorado House passed HB24B-1001 on Wednesday hoping it will help reduce property taxes.

News releases from both House Democrats and House Republicans shared their take on the legislation.

”We are committed to making Colorado a more affordable place to live, and with this bill we’re delivering additional property tax relief in a responsible way while protecting funding for our schools, parks, libraries and community institutions,”said Speaker Julie McCluskie, D-Dillon.“Two initiatives from wealthy special interests on the November ballot would de-fund schools, lengthen emergency response times, and strip health care away from our most vulnerable Coloradans. Stopping these measures with small changes to the bipartisan property tax package from last session is a win for Colorado, our schools and local governments.”

A news release from House Republicans stated the bill is “not a perfect solution.”

“This bill is a balanced, bipartisan plan to deliver additional property tax relief to Coloradans,” said Minority Leader Rose Pugliese, R- El Paso County. “Our local governments need stability to plan their budgets and provide essential services. It also protects the Homestead Exemption for our seniors, disabled, and Veterans in our communities. Our constituents are looking to us for help and I am proud of the work we have done in this bill to provide them with additional property tax relief.”

The bill now goes before the Senate.

Click here to read the bill.

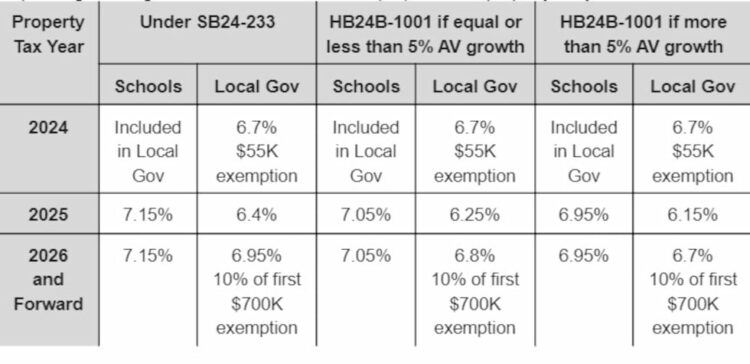

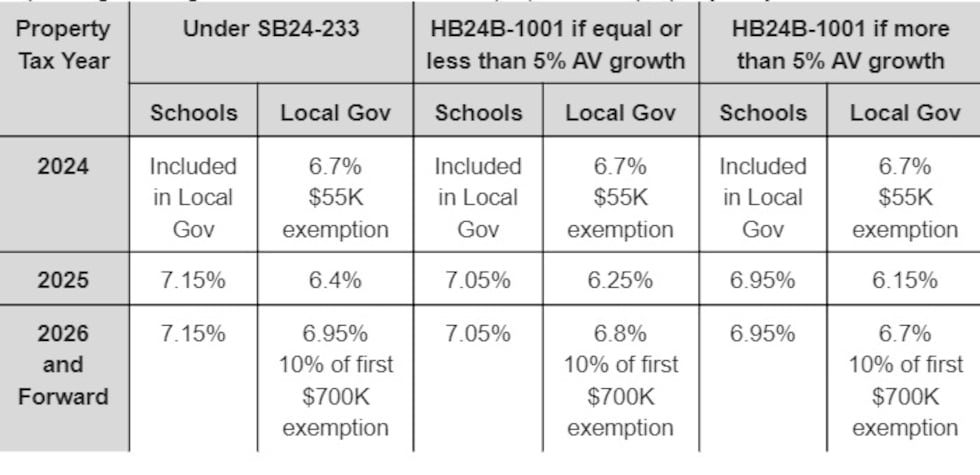

House Democrats provided charts on how rates will be assessed:

Residential Assessment Rates (RARs)

Depending on the growth in assessed valuation (AV) between property tax years 2024 and 2025, there are two options for adjustments to RARs:

Residential Assessment Rates(Colorado House Democrats)

Residential Assessment Rates(Colorado House Democrats)

*RARs and value exemptions apply to and stack with the Senior Homestead Exemption.

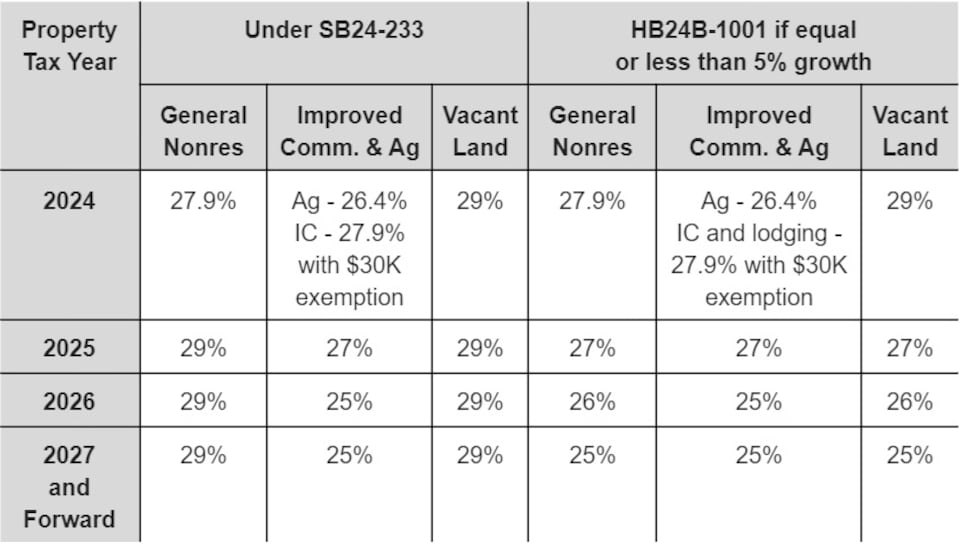

Nonresidential and Personal Property Assessment Rates

Nonresidential assessment rates and exemptions are for both schools and local governments. Oil, gas and producing mines remain excluded from this classification.

Nonresidential and Personal Property Assessment Rates(Colorado House Democrats)

Nonresidential and Personal Property Assessment Rates(Colorado House Democrats)

Copyright 2024 KKTV. All rights reserved.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66cfc85f22d14452a3a8b35a450b6531&url=https%3A%2F%2Fwww.kktv.com%2F2024%2F08%2F28%2Fproperty-tax-bill-passes-colorado-house-during-special-session%2F&c=11623760371527105731&mkt=en-us

Author :

Publish date : 2024-08-28 13:52:00

Copyright for syndicated content belongs to the linked Source.