Advocates kicked off a public awareness campaign Tuesday for new Nebraska child care tax credits, and this is part of promotional material that will be available in English and in Spanish. (Courtesy of First Five Nebraska)

LINCOLN — Child care advocates on Tuesday launched a campaign to build awareness of a new Nebraska tax credit package described by one expert as a state and national milestone for both the industry and parents.

“This is the most expansive and most robust tax credit program that’s available for the child care industry and for parents in the United States,” said Elizabeth Everett, deputy director of First Five Nebraska, which was created in 2011 to focus on early childhood care.

She called the credits approved last year by the Legislature “huge” — in the anticipated financial boost to working families and in seeking to reverse the exodus of child care centers and workers across the state.

‘One of the biggest’ achievements

Between 2022 and 2023, First Five statistics show a 30% turnover in the total early childhood workforce.

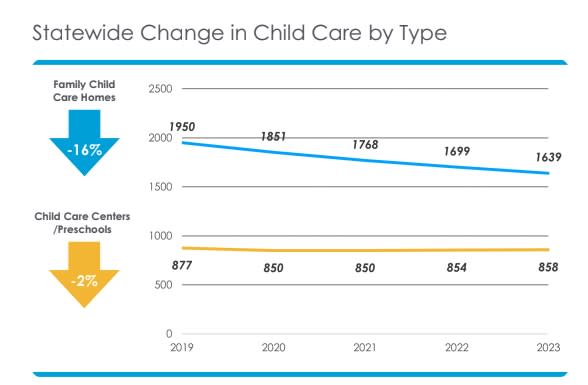

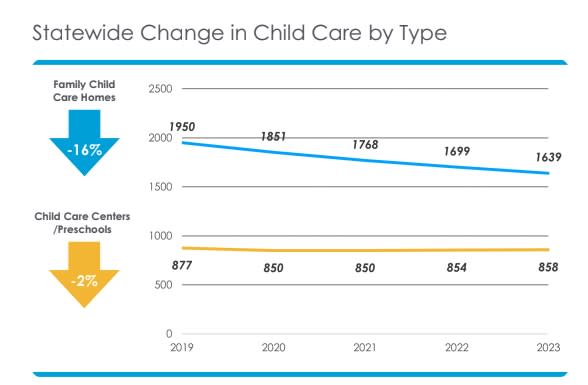

Over the past five years, the state has seen a 12% decline in licensed child care programs. Home-based child care centers, which make up the bulk of providers, declined by a reported 16%.

“This is one of the biggest things that we were able to do for the child care space in the last few decades,” Everett said of the bipartisan-supported credits championed last year by State Sen. Eliot Bostar of Lincoln and adopted as part of Legislative Bill 754.

Everett was joined at a news conference by Bostar and Bryan Slone of the Nebraska Chamber of Commerce and Industry to review the credits and announce the public education campaign and websites created to promote and apply for them.

The Legislature capped at $25 million the available annual credits to be provided on a first-come-first-served basis under the package that goes into effect with the 2024 tax year.

That lawmakers put no sunset or expiration year on the credits was also big, Everett said.

“The unique thing for us is we were able to pass something during a time when a lot of other states weren’t seeing child care bills passed,” she said.

Bostar emphasized the importance of making more Nebraskans aware of the credits, and he lauded the strategy to get the word out to schools, businesses, tax preparers, families and others.

A key and later phase of the campaign will look at what did and did not work in connecting families, businesses and organizations with the tax credits, the advocates said.

“The importance of child care to our state really can not be overstated,” Bostar said.

A primary factor holding back workforce growth and development in the state, he said, is the lack of access to child care.

“It’s an industry that’s currently struggling,” Bostar said, noting the closure of day care facilities in his district. “The margins in a lot of cases are practically non-existent to make a child care program work.”

Vital for ‘people attraction’

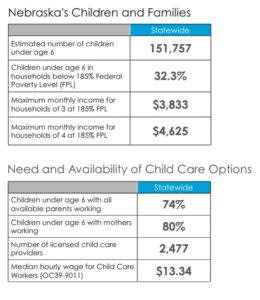

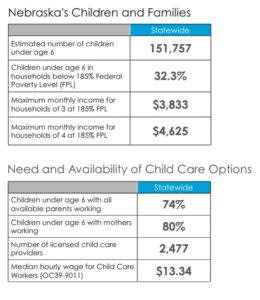

According to First Five, as many as three-quarters of Nebraska children under age 6 have all available parents in the workforce. The group said that as the costs of raising young children increase, so do wage and operational challenges of child care providers.

A study done for the nonprofit in 2020 said that insufficient options for affordable and reliable child care takes a toll, a reported nearly $745 million annually, in losses for Nebraska families, businesses and state tax revenues.

Slone said that as his team traversed the state and held forums in the past three years, child care was at or near the top of community priorities.

“People attraction — particularly the attraction of young families to Nebraska — is absolutely the key to Nebraska’s future both from an economic standpoint and community sustainability standpoint,” Slone said.

He said the state must do better to beef up the industry’s workforce and number of licensed child care seats, which falls short of demand in regions across the state.

Slone said the tax credits targeted at business and philanthropists present an opportunity to make a difference in their communities.

“These credits help businesses to take on an enhanced role in supporting access to child care, a crucial industry that keeps Nebraskans productive and engaged in their jobs,” he said.

First Five, working with the Nebraska Children and Families Foundation, has launched various websites for each available credit, explaining eligibility and the application process.

Applications are required for the various credits, and first must be submitted to the Nebraska Department of Revenue, the nonprofit said.

Radio and television ads are to begin airing in November. Those and other materials are to be available in English and Spanish.

Nonprofits, service providers, schools, tax and accounting services, employers and municipal entities are helping in the effort, said Everett.

“Creating the tax credits was just the first step,” she said. “No matter how urgently these supports are needed in our state, their impact depends entirely on how widely they are understood and used by those they are meant to help.”

New tax credits

The new tax credits:

Child Care Tax Credit-Refundable (CCTC-R): For eligible families with young children under age 5, this credit helps offset some financial pressure by offering either a $1,000 or $2,000 annual credit per child, depending on household income and other requirements.

Child Care Tax Credit-Nonrefundable (CTC-NR): Targeted at businesses, philanthropic organizations and other contributors, this credit is intended to encourage the private sector to help grow child care availability, especially in economically challenged areas. Tax paying individuals or organizations can apply for credit equal to either 75% or 100% of a qualifying contribution if the recipient of the contribution operates a program in a Nebraska Opportunity Zone or serves children on child care subsidy. The total credit amount cannot exceed $100,000 per year.

School Readiness Tax Credit-Refundable (SRTC-R). This offers a refundable tax credit between $2,300 and $3,500 to eligible, individual child care staff members or self-employed child care providers. It is intended to encourage career development for child care professionals. The amount of the credit is based on professional classification criteria set by the Nebraska Department of Education.

School Readiness Tax Credit-Nonrefundable (SRTC-NR): Available to qualifying owner-operators of child care programs, this credit encourages providers to grow the quality and availability of programs serving families in greatest need. The amount is determined by the program’s Step Up to Quality rating and the average monthly number of children enrolled in the Nebraska Child Care Subsidy program during the tax year, ranging between $400 and $1,200 per child.

Refundable vs. Nonrefundable tax credits: Refundable tax credits are subtracted from the amount of tax owed when a tax paying individual or organization files a state income tax return. If the amount of the tax credit is larger than the tax liability, the difference is refunded to that filer. Nonrefundable tax credits can reduce the tax a filer owes to zero, but won’t provide refunds.

SUBSCRIBE: GET THE MORNING HEADLINES DELIVERED TO YOUR INBOX

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66ce62e7a372481091f6dcd134a35d51&url=https%3A%2F%2Fwww.yahoo.com%2Fnews%2Fawareness-campaign-launches-ne-child-210018116.html&c=10864966939469714032&mkt=en-us

Author :

Publish date : 2024-08-27 10:00:00

Copyright for syndicated content belongs to the linked Source.