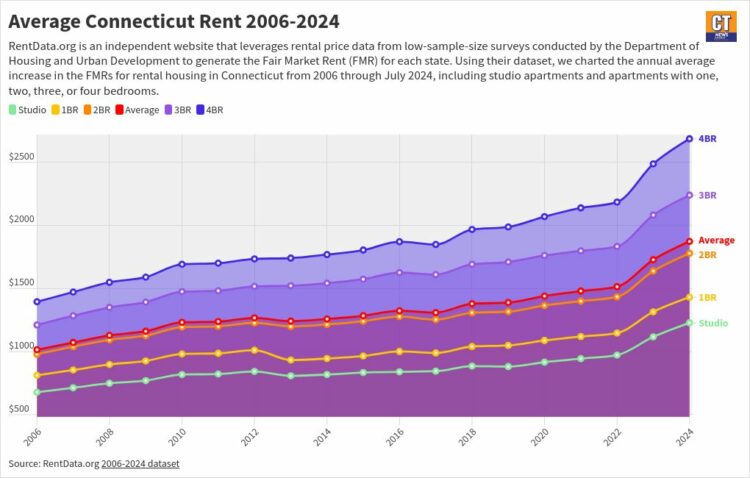

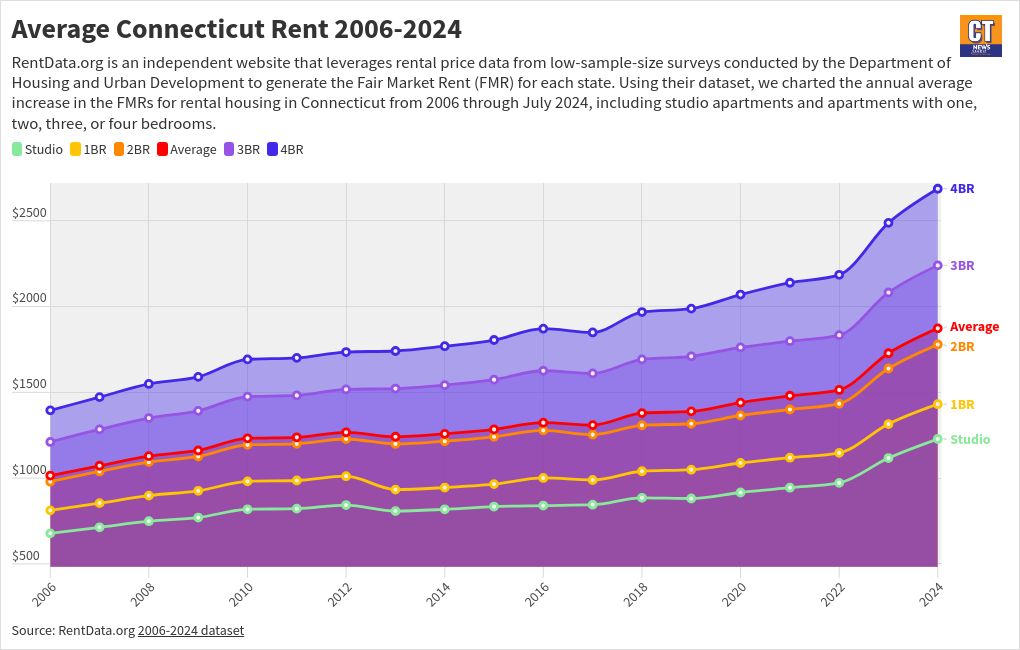

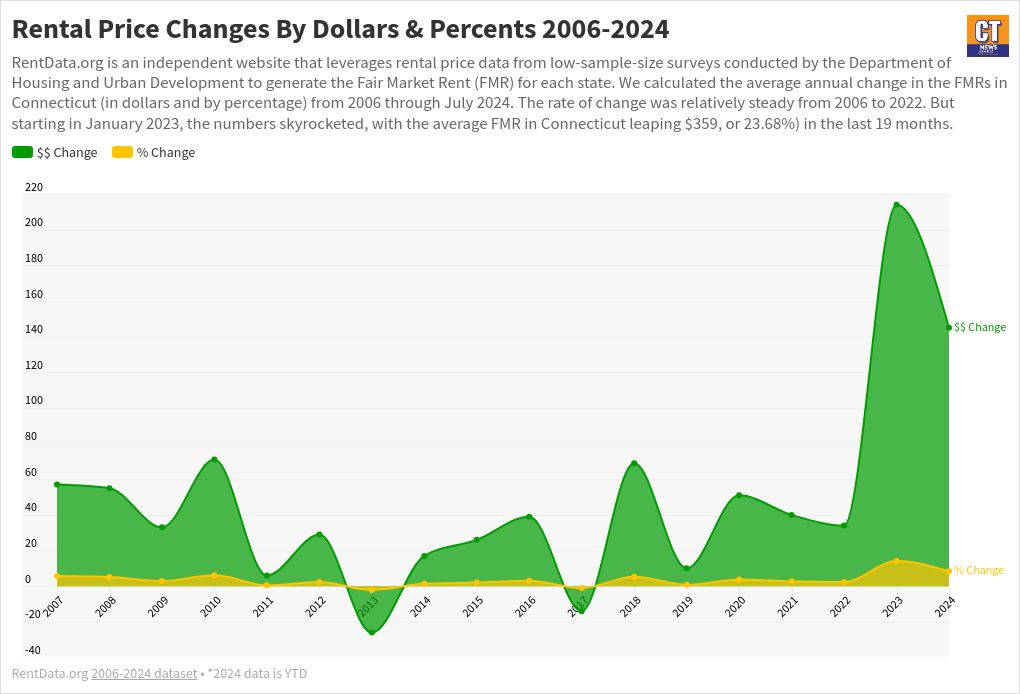

A look at the latest data from the Department of Housing and Urban Development (HUD) shows a $359 jump in the average cost of the “Fair Market Rent” in Connecticut since the end of 2022, a 23.68% increase from $1,514 to $1,873.

That’s according to RentData.org, which pulls in data from HUD and provides their Fair Market Rent (FMR) costs by state, year, and apartment size. They also provide an average FMR combining all the data for studio apartments and apartments with one, two, three, or four bedrooms throughout the state.

The data, shown below in two charts, illustrate an astounding leap in the FMR for Connecticut apartments over the last 19 months in comparison to the previous 17 years. While the trend was upward from 2006 to 2022, it only averaged 2.56% a year. From Jan. 1, 2023, through Aug, 26, 2024, the average annual increase is about 11.25%. And that seems likely to rise by the end of 2024 because of how the FMR is calculated.

FMRs are based on randomly dialed, small-sample telephone surveys that bypass the Do Not Call Registry, as well as rent data from the US Census Bureau. RentData says its FMRs are “gross” prices, meaning they include utility costs, some of which are high in Connecticut. And since Connecticut just saw a big electricity rate hike that started in July, the average FMR for 2024 is likely to go up by year’s end.

Is The Dataset Accurate?

The state Department of Housing appears to use both Redfin and HUD data on its Housing Data Hub, although the latest sample available on the state’s website is 2016-2020. However, the Housing Department’s calculation of the median rent for that year ($1,175) matches the median rent price using the 2016-2020 numbers from RentData.org.

Additionally, Redfin’s current median rent for Connecticut is listed at $1,816, while RentData has it in the same ballpark at $1,873. The Zillow app, which provides listings for homes for sale as well as rentals, lists the current median rent in Connecticut at $2,000, but it gathers its data from a variety of sources with a different method.

Here are two visualizations of the data:

So while it’s not entirely clear exactly why Connecticut’s FMR average has jumped $359 in the last 19 months, the spike may also be attributable to other factors in the housing market.

One of those may be the proliferation of revenue management software within the rental housing industry to help landlords and property management firms improve their revenue.

Anti-Trust Lawsuit Filed

On Friday, Connecticut Attorney General William Tong announced that the state had joined attorneys general from all over the country in an anti-trust lawsuit against RealPage Inc., which provides landlords access to its AI Revenue Management (AIRM) and Yieldstar software services. The company says the software aggregates anonymized “internal” rental price and occupancy/availability data from landlords or property managers and helps users “optimize” their profits by helping them determine “price elasticity of demand” and “thus the appropriate magnitude of change in price.”

It’s not clear from RealPage’s website how much landlords pay to use the software, but it is part of a suite of pricing advisory services that include group chats and other services.

Tong and other attorneys general, as well as US Sen. Richard Blumenthal, who sponsored two bills in March to crack down on landlords’ use of the software, say it is simply a way for the industry to illegally engage in collusion and price-gouging to manipulate the market and drive rents upward.

RealPage’s market coverage map says the company is operating in 200 markets and 1,000 submarkets across the US.

In Connecticut, according to RealPage’s website, those include:

Bridgeport/Stamford/Norwalk

Hartford

New Haven, and;

Norwich/New London.

Aside from the larger companies that use AIRM and Yieldstar, the complaint says internal documents from RealPage indicate that its software also “commands an 80% share” of the conventional multifamily housing rental market.

The 110-page complaint further describes numerous statements in group chat conversations or emails between landlord users and company representatives, during which they discuss the use of anticompetitive strategies and in some cases state that they are aware that they are anticompetitive practices.

“Landlords understand the sensitivity of the information being shared and the likely anticompetitive effects,” the complaint says on page 48. “One potential client put it succinctly to RealPage: ‘I always liked this product [AIRM] because your algorithm uses proprietary data from other subscribers to suggest rents and term. That’s classic price fixing . . .’”

In other evidence, the complaint says AIRM and YieldStar are harming the competitive process by discouraging the use of discounts and price negotiations with a goal of 100% of their landlord clients clicking to accept the software’s price recommendations.

“In a competitive marketplace, each landlord may independently decide to offer concessions so that it can better compete in enticing lessors,” the complaint says on Page 53. “But, again, RealPage seeks to replace fully independent, competitive decision-making with collective action by ending concessions. AIRM and YieldStar do not work as well when landlords use one-off or lumpy concessions. In its ‘best practices’ for revenue management to landlords, RealPage’s guidance is simple: ‘Eliminate concessions.’ Detailed ‘best practices’ documents for both YieldStar and AIRM users explain that ‘concessions will no longer be used in conjunction with’ YieldStar and AIRM.”

A 2023 RealPage client presentation showed that the number of units offering concessions – or discounts – had trended downward from about 30% in 2013 to less than 15% in 2023, the complaint says. “The software also discourages price negotiations, essentially training landlords that “YieldStar [or AIRM] is managing your price,” so that staff can be freed up to focus on other tasks.

The complaint says AIRM and YieldStar make it easy to accept their recommendations while making it more difficult and time-consuming to decline them, also pushing clients to adopt “auto-accept” settings that automatically approve recommendations.

The company’s definition of an accepted recommendation, according to the complaint, is a final scheduled price within 1% of the software’s recommendation. The complaint says that between 40% and 50% of landlords were using prices within 1% of the recommendation. However, the also complaint says that the software’s influence is evident when the variance is widened only slightly. Within 2.5% of the final price, nearly 60% of the landlords were in compliance, and within 5% of the final price, 85% of RealPage’s client landlords were in compliance.

The complaint also documented landlords repeatedly discussing competitively sensitive topics with competitors and swapping information. They regularly solicited and obtained nonpublic information about prospective renters’ inquiries, occupancy levels, and rents from their direct competitors, according to the complaint. Some landlords used Google Drive documents to share information on their local geographic markets with other landlords.

The complaint alleges that one RealPage employee explained to his colleagues, reflecting on his former employment with a landlord, that these weekly inquiries “required cooperation among the comp[etitor]s but [it] wasn’t hard to get that.”

Further, in June 2023 a senior director with a leasing company admitted that “this practice has been prevalent in our industry for a long time.”

Aside from RealPage client landlords sharing information with each other directly, one client was documented saying that the price recommendations were based upon the very data that could lead to collusion, regardless of whether it was anonymized.

Further, the complaint says AIRM and YieldStar are set up to favor recommended price increases over price decreases.

“When the model calculates that the current day’s ‘optimal’ price will result in greater revenue than the previous day, a feature called the ‘governor’ causes the model to recommend the current day’s optimal price,” the complaint says. “But when AIRM or YieldStar calculates that the current day’s optimal price will result in less revenue than the previous day, the governor recommends the recent average price even though it is not optimal for the current day.”

The complaint continued: “In other words, when market conditions weaken and the model calculates that a price decrease is warranted, this guardrail kicks in and recommends keeping the recent rent even though it is suboptimal. This asymmetry favors price increases over price decreases.”

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66cc479a40314109b4a5f822a6f96900&url=https%3A%2F%2Fctnewsjunkie.com%2F2024%2F08%2F26%2Fanalysis-average-cost-of-fair-market-rent-up-359%2F&c=17832808107674770729&mkt=en-us

Author :

Publish date : 2024-08-25 22:00:00

Copyright for syndicated content belongs to the linked Source.