Over the last 7 days, the United States market has risen 4.0%, contributing to a remarkable 25% climb over the past year, with earnings forecasted to grow by 15% annually. In this thriving environment, identifying undiscovered gems that offer strong growth potential and solid fundamentals becomes crucial for investors looking to capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

Name

Debt To Equity

Revenue Growth

Earnings Growth

Health Rating

Morris State Bancshares

10.20%

-0.32%

6.73%

★★★★★★

San Juan Basin Royalty Trust

NA

39.20%

40.92%

★★★★★★

Teekay

NA

-6.48%

55.79%

★★★★★★

Mission Bancorp

25.37%

16.23%

20.16%

★★★★★★

Omega Flex

NA

1.31%

3.88%

★★★★★★

First Northern Community Bancorp

NA

7.12%

10.04%

★★★★★★

United Bancorporation of Alabama

13.34%

18.86%

25.45%

★★★★★☆

Valhi

38.71%

2.57%

-19.76%

★★★★★☆

Planet Image International

119.30%

2.39%

0.80%

★★★★★☆

FRMO

0.19%

6.49%

15.82%

★★★★☆☆

Click here to see the full list of 222 stocks from our US Undiscovered Gems With Strong Fundamentals screener.

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Value Rating: ★★★★★★

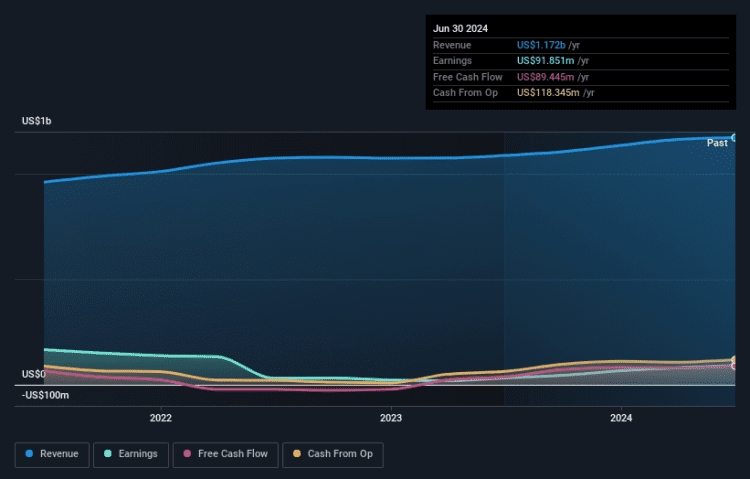

Overview: National HealthCare Corporation operates skilled nursing facilities, assisted and independent living facilities, homecare and hospice agencies, and health hospitals with a market cap of $1.94 billion.

Operations: National HealthCare Corporation generates revenue primarily from inpatient services ($991.67 million) and homecare and hospice ($134.96 million). The company also has a smaller revenue stream from other sources amounting to $60.61 million.

National HealthCare (NHC) has seen impressive earnings growth of 187.7% over the past year, significantly outpacing the healthcare industry’s 5.8%. Despite a one-off gain of US$48.5M impacting recent results, NHC remains debt-free with a P/E ratio of 21.8x, below the industry average of 28.4x. The company also reported second-quarter revenue at US$300.66M and net income at US$26.84M, reflecting solid financial health and profitability without concerns about cash runway or interest coverage due to no debt obligations.

NYSEAM:NHC Earnings and Revenue Growth as at Aug 2024

Simply Wall St Value Rating: ★★★★☆☆

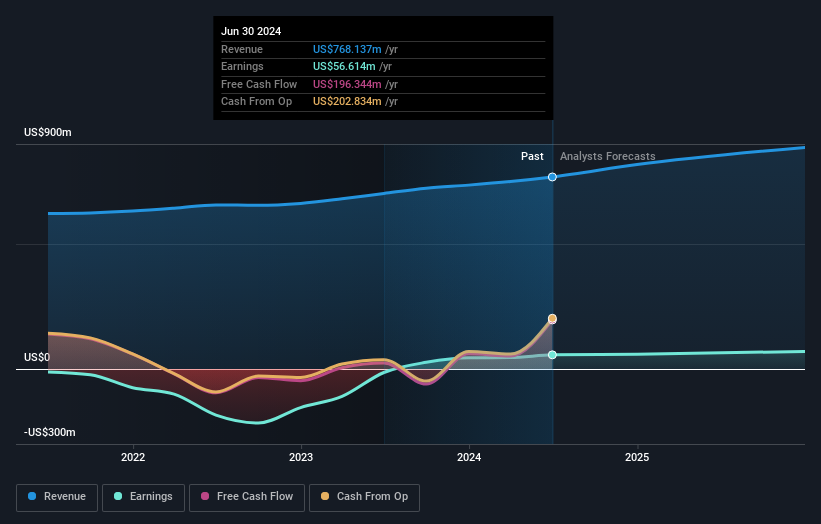

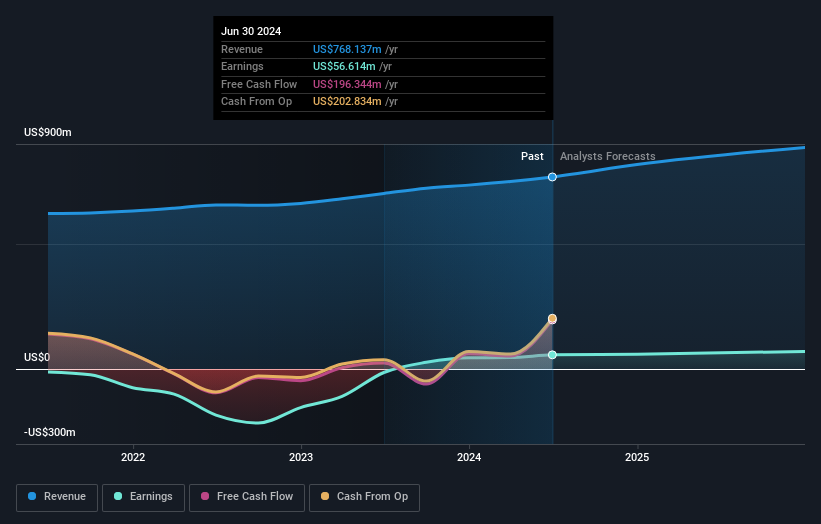

Overview: Heritage Insurance Holdings, Inc., through its subsidiaries, provides personal and commercial residential insurance products and has a market cap of $374.96 million.

Operations: Heritage Insurance Holdings generates revenue primarily from its Property & Casualty insurance segment, amounting to $768.14 million. The company has a market cap of $374.96 million and focuses on personal and commercial residential insurance products.

Story continues

Heritage Insurance Holdings, a smaller player in the insurance sector, recently reported second-quarter revenue of US$203.57 million and net income of US$18.87 million, up from US$185.31 million and US$7.78 million respectively a year ago. The company’s price-to-earnings ratio stands at 7.2x versus the market’s 17.2x, indicating good value relative to peers. Despite shareholder dilution over the past year, Heritage has high-quality earnings and its debt is well-covered by EBIT at 6.9x coverage ratio.

NYSE:HRTG Earnings and Revenue Growth as at Aug 2024

Simply Wall St Value Rating: ★★★★★☆

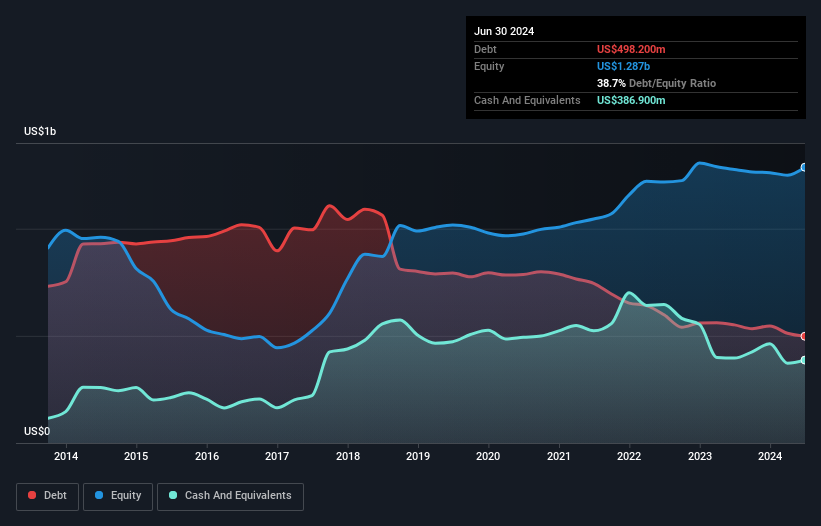

Overview: Valhi, Inc. operates in the chemicals, component products, and real estate management and development sectors across Europe, North America, the Asia Pacific, and internationally with a market cap of $618.24 million.

Operations: Valhi, Inc. generates revenue primarily from its chemicals segment ($1.78 billion), followed by component products ($157.40 million) and real estate management and development ($78.50 million).

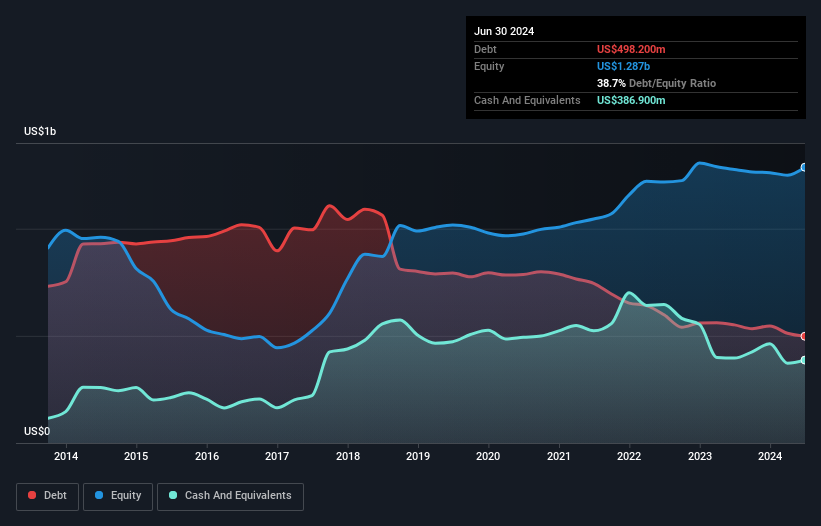

Valhi’s earnings surged 215.4% over the past year, outpacing the Chemicals industry’s -7.7%. The company’s debt to equity ratio improved from 78% to 38.7% in five years, reflecting better financial health. Valhi’s net income for Q2 2024 was US$19.9 million compared to a loss of US$3.2 million last year, and its EBIT covers interest payments by 4.7 times, indicating strong profitability and efficient debt management

NYSE:VHI Debt to Equity as at Aug 2024

Make It Happen

Dive into all 222 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St’s portfolio, where intuitive tools await to help optimize your investment outcomes.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NYSEAM:NHC NYSE:HRTG and NYSE:VHI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66bf376d81e842e881d3ff894c098dff&url=https%3A%2F%2Ffinance.yahoo.com%2Fnews%2Fundiscovered-gems-united-states-august-111142470.html&c=13302466354334671684&mkt=en-us

Author :

Publish date : 2024-08-16 00:11:00

Copyright for syndicated content belongs to the linked Source.