8-minute read

Drawing new industry to New Jersey has been a priority for the administration of Gov. Phil Murphy. Packaging the Garden State as a friendly place to do business is an ongoing effort by the state Economic Development Authority, which works to offer generous incentives — including tax breaks.

In recent years, New Jersey has offered these significant tax incentives:

$758 million for the film and television industry$500 million for artificial intelligence development$109 million for financial technology firm Fiserv and nearly $10 million for Party City — both in New Jersey’s affluent suburbs

Murphy, members of the Legislature and leaders at the EDA believe these are investments that will help boost the state’s economy.

But do they help New Jersey or its residents? That’s less defined.

Peter Chen, a senior analyst at the non-partisan New Jersey Policy Perspective, said that it’s hard to measure whether or not tax incentives are beneficial to the state. He said it’s not clear whether or not the incentives drive investments that otherwise wouldn’t be made in New Jersey or whether state officials are simply rewarding companies who would be doing business here anyway.

“If you want to attract someone to your area, you’ve got to offer them more tax credits than the other guys are offering. The question is, does it actually help the economy?” Chen said.

This isn’t a new concept. Some of the state’s first iterations of competitive tax breaks stretch back to the early 2000s.

And in 2018, multiple states engaged in an all-out bidding war to attract Amazon’s HQ2 — a proposed massive second headquarters that would have entailed $5 billion of construction and 50,000 new workers.

New Jersey was among the contenders, putting a $5 billion subsidy on the table, before the internet shopping giant opted to split the project between Long Island City in New York and Crystal City in Virginia.

The New York location was canceled after the community raised intense concerns about its impact and the incentive package with the most vocal being Rep. Alexandria Ocasio-Cortez, the progressive Bronx Democrat. Construction is still not complete in Virginia.

“The economy changes, plans change, and it’s hard to carry through on something like that,” said Will Irving, a professor at the New Jersey State Policy Lab at Rutgers University in New Brunswick.

While the governor’s office didn’t answer questions about these specific programs, administration spokesperson Tyler Jones said they are “committed to building on the emerging film and generative AI industries in New Jersey. These incentives will see to it that companies continue to set roots and grow here in our state.”

How does the film and television industry benefit in New Jersey?

The film and television industry is notably mobile and has a tendency to jump from location to location, depending on tax incentives offered by state and local governments. That creates what Chen called a “race to the bottom.”

Some major studios are moving ahead with infrastructure plans that would earn them hundreds of millions in tax breaks in New Jersey. Netflix is working on a $1 billion soundstage at Fort Monmouth, which would earn it $125 million in incentives while Lionsgate is building a $194 million, 350-square-foot studio in Newark, which qualifies for up to $100 million in tax breaks.

Despite those investments, Chen said New Jersey residents should remain skeptical because “even a giant soundstage can be emptied” and that ultimately chasing the industry is a “fool’s errand.”

“The film and TV tax credit is particularly galling because there’s so much research on this specific industry that shows that the return on investment is not good,” he said. “You end up paying more and more and more and more and getting less back, because you have to ‘compete with these other states’ but really, the only people winning are the film studios, right? They’re the ones who are just running away with cash.”

Audrey Lane, president of the pro-business Garden State Initiative, noted that there’s not much of a “safety net in terms of making sure these businesses stay” in New Jersey. Lane also said the newly established corporate transit fee — which by all accounts is an updated version of the surtax many New Jersey companies paid through the now-defunct corporate business tax program — may create even less incentive for the film and television industry to stay in New Jersey for the long term.

Lane also agreed that tax credits for the film and television industry provide the least benefit to a state economy because “they don’t boost the smaller businesses and they both tend not to use local talent.”

“One can attract any industry if one subsidizes 30% of its labor costs,” said Tim Bartik, senior economist at the W.E. Upjohn Institute for Employment Research in Kalamazoo, Michigan. “But it is impossible to provide such huge subsidies for very many projects. It is unclear what are the benefits from subsidizing films for a state’s economy.”

The state’s film and television tax break program lacks what’s known as a “net benefits test,” according to a 2018 fiscal note from the nonpartisan New Jersey Office of Legislative Services.

That test is employed in most other tax break programs to make sure that the program actually yields an economic benefit to the state.

“Without the net benefit test requirement, projects will also be eligible for tax credits that taxpayers would have undertaken with or without the state subsidy,” the note reads.

Tim Sullivan, CEO of the state’s Economic Development Authority, argued that filming on location does benefit local New Jersey communities because the productions buy food from local restaurants and groceries and often hire contractors for set work , like electricians and carpenters.

“We’re on our way to being a $1 billion film industry, and this is just the beginning,” Sullivan said. “It’s a really competitive marketplace. A tax credit is sort of the table stakes. The key to long term success in the film and television business or industry is getting people to make investments in brick-and-mortar locations, because once those exist, you’re going to have long term success.”

Sullivan pointed to some of the economic benefits Georgia has enjoyed since Tyler Perry deveolped film studios in Atlanta and said that Netflix and Lionsgate have both signaled long-term committments to New Jersey. Success, he said, will be measured through job creation and the volume of filming.

One of the most tax subsidies approved by the EDA was for NFL Productions, which has had facilities in Mount Laurel since 1979. NFL Productions is likely to secure $51 million in digital media tax breaks for projects dating back to 2018 with the most recent project completed in 2023. The production company applied for the tax incentives in March and saw them approved last month.

NFL Productions did respond to questions regarding their tax breaks or presence in the state.

And sometimes the investments made by the state in the film industry aren’t even used to benefit the companies that garner the breaks in the first place.

The production company behind “The Trial of the Chicago 7,” a 2020 film that premiered on Netflix, ended up selling a $5.2 million tax credit to Apple for $4.8 million, as reported by The New York Times in March. That transaction allowed Apple to apply that tax credit to its own tax liability — in effect, subsidizing itself.

How does artificial intelligence development benefit in New Jersey?

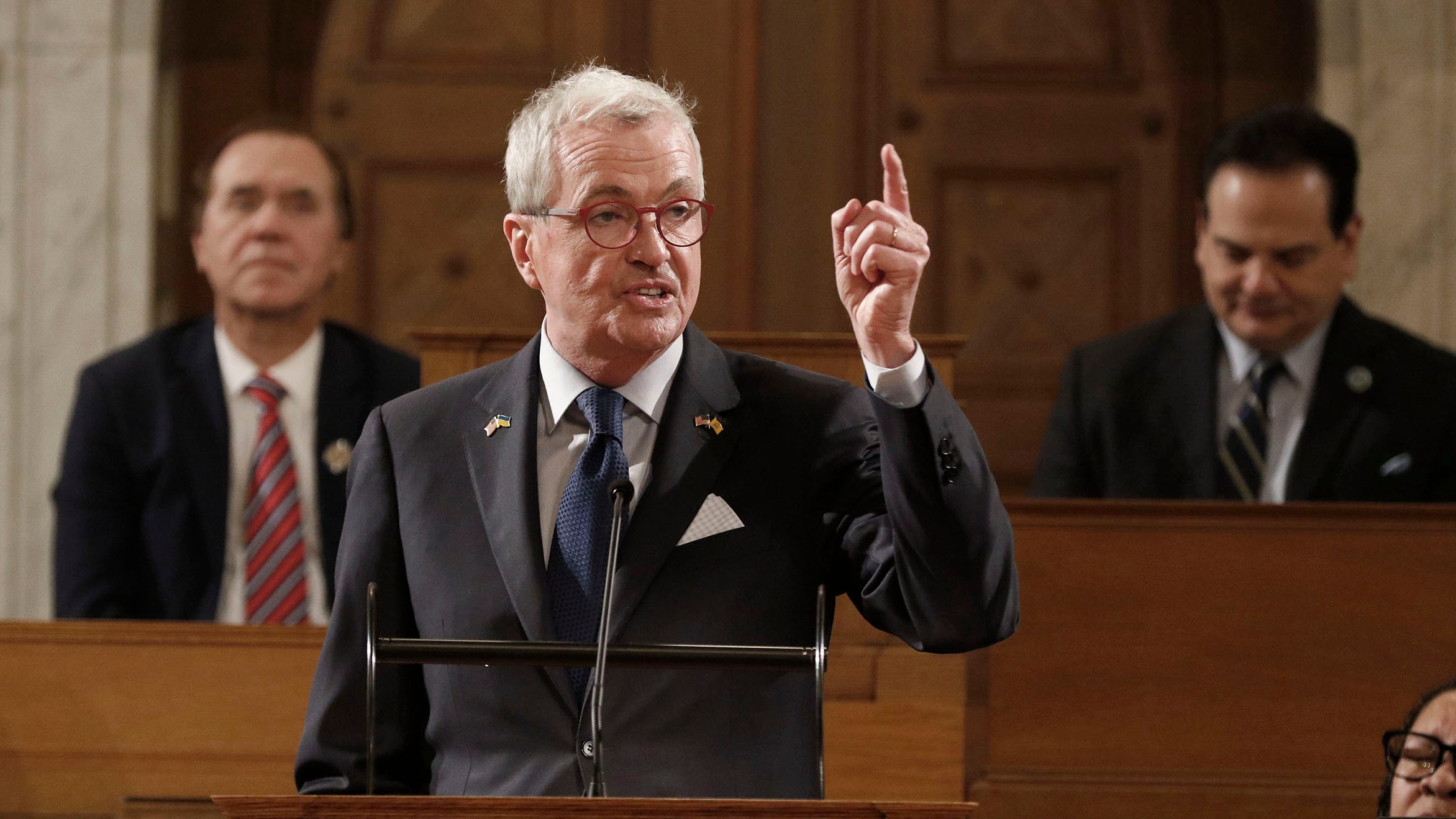

Phil Murphy on NJ leaders in A.I. during 2024 State of State Address

Governor Phil Murphy’ discusses leading the country in artificial intelligence at the 2024 State of the State Address.

The state is also creating huge incentive programs to attract companies working to develop a range of artificial intelligence technologies.

Like the film industry, Chen also thinks there’s a “very narrow window where there’s actually going to be the return investment that you’re hoping for.

“Every time I open my phone, another app is telling me to use their AI assistant instead of just like letting me search what I actually want,” Chen said. “So they don’t seem to have any problem researching AI, and they certainly don’t need state investment to do it.”

A new state law, signed by Murphy last monrth, will set aside tax breaks for businesses that collect more than half of their revenue from artificial intelligence, or use more than half their staff for that purpose. Businesses would be eligible for incentives worth up to $250 million.

This program also lacks the what the state OLS calls the “net benefits test” to ensure the tax breaks actually result in an economic benefit for the state — according to a July 10 fiscal note.

“The net benefit test is intended to ensure that the authority will award incentives only to projects that are estimated to generate indirect State revenue in excess of a tax incentive’s direct state cost,” the note reads.

The legislation doesn’t have any guard rails for the work to be done either, Chen said, so those utilizing it might be AI startups or it might lead to a “bunch of giant data centers which do nothing except suck energy out of our electric grid.”

He cited language in the law that requires “minimal compliance with environmental and labor standards” which does not fit the image of a cleaner, more eco-friendly state that New Jersey has strived for.

According to the annual electricity report by the International Energy Agency, which the United States is a member of, data center electricity consumption is expected to grow rapidly in the next few years and is expected to take up 6% of the country’s total electricity demand by 2026.

The impact on the state’s energy grid is a concern for Lane as well because, she said, in addition to supporting an increase in demand, it could affect the cost of energy for residents.

Will Irving, a professor at the New Jersey State Policy Lab at Rutgers University, noted that the state already has a number of large-scale incentive programs that a company specializing in AI could tap into.

That program is NJ Emerge, which aims to keep business from leaving the state, and also tries to attract new corporations to New Jersey, particularly in economically downtrodden areas.

“It’s simply because AI is such a hot topic right now, such a hot term, I’m not sure how this would necessarily differ from any of the targeted industries they already identify, which are mostly high-tech industries,” Irving said.

Sullivan acknowledged that the new program creates an imbalance for the state’s work toward achieving climate goals so they will “certainly be encouraging any data centers or any infrastructure investments to use clean energy as much as they can, whether that’s wind or solar, by buying wind or solar or various other things.”

He noted that the program will provide access to big cloud infrastructure which is a “really scarce resource” by requiring a “public-private partnership where New Jersey startups, New Jersey innovators, New Jersey universities,” get access to this computing power.

Success would again be measured through job growth and capital investment.

“Decisions about where these companies set up shop, where they build their supply chains, how they how they build their infrastructure, matters now for the next 50, 100 years,” Sullivan said.

Are there other ideas to lure business to New Jersey?

Not all tax incentive programs are bad, though. Chen thinks if the Murphy administration wants to attract business, it should lean into programs that already work.

“We have very high housing costs. The state could do more to invest in building more housing,” Chen said. “Even if you were going to choose among the various programs that are already under the EDA umbrella … you can focus more on development that includes affordable housing.”

And the state already has dozens of programs for small businesses and startups, which essentially use taxpayer dollars to help support those endeavors.

Focusing on programs that already exist — especially those with more “guardrails,” as Chen put it — also makes things easier for the state employees tasked with overseeing these things.

Chen called the AI program a “very squishy program” and noted that while the EDA is doing well now there have been times when “lax oversight” has led to an “abuse of the tax credit system.”

Those abuses came to light when a task force convened by Murphy scrutinized whether several companies with ties to political powerbroker George Norcross actually intended to leave Camden in South Jersey and move to neighboring Philadelphia just across the Delaware River.

A WNYC analysis in 2019 found that two-thirds of the tax break awards in Camden, or more than $1 billion, went to companies connected to Norcross, under a program known as Grow New Jersey, which was enacted by former Republican Gov. Chris Christie.

Later that year, the task force honed in on the Blue Hill Plaza — a 20-story office tower in Pearl River, New York just over the Bergen County-Rockland County border — and how businesses listed it as an alternative site when threatening to leave the state.

Between 2013 and 2019, the EDA approved 15 applications for businesses that threatened to relocate to Blue Hill.

The “overuse” of Blue Hill was one of the most “egregious” findings by lawyers hired by Murphy to investigate the controversial Grow NJ program, said Jim Walden, one of the lead attorneys.

“The whole reason behind creating Aspire and Emerge and redoing all the EDA programs back in 2021 was to add more accountability measures and now it seems like every year … they’re finding a way to loosen the accountability measures further,” Chen said.

Programs like Aspire were created with the idea that the government can help subsidize certain kinds of development and business projects that can’t exist otherwise because there’s a market failure around investing in certain communities or investing certain projects, Chen said.

Chen said that the AI program has “no community benefit agreement” and is “essentially the state just acting as an investor trying to attract a business through direct subsidy.”

“Historically, we’ve seen across the country that these are not particularly successful types of investment, and that instead governments should be focused on creating good places for people to live, investing in higher education, investing in incubators of economic development,” Chen said.

Lane said tax credits in general are a “bit of acknowledgement that your basic tax system is a little bit imbalanced in the first place.

“It has the state picking winners and losers as far as industry, and in the end, it really doesn’t recognize the industries that have been here, through thick and thin, the industries that have stuck it out and been here in New Jersey, built their businesses here and continue to provide jobs,” she said.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66b0a7b01ddc4c0d94f9c6cc94aed723&url=https%3A%2F%2Fwww.usatoday.com%2Fstory%2Fnews%2Fnew-jersey%2F2024%2F08%2F05%2Fnj-tax-incentives-film-tv-ai-state-benefits%2F74589501007%2F&c=13289711688052117657&mkt=en-us

Author :

Publish date : 2024-08-04 22:29:00

Copyright for syndicated content belongs to the linked Source.