Good morning. Joe Biden is taking aim at the Supreme Court, calling on Congress to impose sweeping reforms of America’s highest court and approve a constitutional amendment denying US presidents immunity from prosecution for crimes committed while in office, according to a White House official.

The proposals highlight how the Supreme Court has become a political flashpoint following a series of controversial rulings by its conservative majority in recent years, including a landmark decision in 2022 that struck down nationwide abortion protections.

The standing of America’s highest court has also emerged as a top issue in November’s presidential election, which is set to pit vice-president Kamala Harris against former president Donald Trump.

Biden, 81, said last week that reforms to the court would be “critical to our democracy” during an Oval Office address in which he formally announced his decision to drop out of the presidential campaign and endorsed Harris for the Democratic nomination.

Our top story today is about the EU’s two-step trade strategy to deal with Donald Trump if he wins a second term as US president. Here’s the full story.

Sign up for the US Election Countdown newsletter to join the FT’s Washington reporter Steff Chávez for your essential guide to the twists and turns of the 2024 presidential election.

EU prepares two-step trade plan to tackle Donald Trump: Brussels is planning to offer the Republican candidate a quick deal if he wins a second term as president, and targeted retaliation if Trump opts for punitive tariffs instead.

Trump and deregulation: The former president’s claims that he was the greatest deregulator in US history are addressing popular frustrations that his rivals do not even recognise, writes Ruchir Sharma.

Kamalanomics: The vice-president must be careful to avoid the trap of getting too close to big business, writes Rana Foroohar.

Here’s what I’m keeping an eye on today:

New UK listings regime: The biggest overhaul of rules for London-listed companies in three decades comes into force.

Companies: Loews, McDonald’s and Philips have results today. Blackstone’s acquisition of Hipgnosis is expected to become effective after the deal was approved by shareholders last month.

Five more top stories

1. Federal Reserve expected to keep interest rates steady but to tee up September cut as US inflation has taken a favourable turn and the labour market continues to soften. The Federal Open Market Committee is poised to again hold its benchmark interest rate steady at a 23-year high of 5.25 to 5.5 per cent when its two-day gathering ends on Wednesday.

UK interest rates: Unexpected strength in UK services inflation has left the Bank of England’s meeting on Thursday on a knife edge, as it weighs a rate cut.

2. Venezuela’s state-controlled election authority has declared authoritarian leader Nicolás Maduro the winner of Sunday’s presidential vote, as the opposition denounced what it said were serious irregularities in the count. Opinion polls before the vote and quick counts on the day had forecast a big opposition win. Here are the latest developments in the crucial election.

3. Exclusive: The UK space agency has come under fire from industry over its latest funding awards, which allocated £33mn to more than 20 companies, including £5mn to the UK subsidiary of HyImpulse, a Germany launcher start-up. “HyImpulse have had more funding from the UK than they have had from the German government,” Phillip Chambers, chief executive of rocket start-up Orbex, told the Financial Times. Peggy Hollinger has more.

4. Roche plans to fast-track its anti-obesity drugs to challenge rivals Eli Lilly and Novo Nordisk in the booming market after unveiling promising data for a weight-loss pill. Thomas Schinecker, chief executive of the Swiss pharmaceutical company, told the Financial Times that Roche’s first obesity drugs would come to market “significantly faster than people are expecting”, potentially by 2028. Read more here.

5. NatWest sues ex-GM unit for €155mn over financial crisis-era deals. The UK bank is suing a mortgage finance company formerly backed by General Motors for more than €155mn over soured securitisation deals struck in the run-up to the financial crisis. The High Court in London last week heard a case brought by the UK bank against CMIS, which was originally part of GM when the US car company was making a push into mortgage finance.

The Big Read© FT Montage/AFP/Getty Images

BlackRock’s Larry Fink has been grooming a new top team for more than a decade. But the recent departures of several second- and third-tier executives, as well as a substantial acquisition and a reorganisation in January that the 71-year-old head described as “transformational”, have increased anxiety internally and among investors about the future of the $10.6tn money manager.

We’re also reading and listening to . . .

Carlyle’s oil strategy: While rivals have backed away from fossil fuel projects, the US buyout group’s London-based energy division has persisted.

The Economics Show 🎧: In this week’s episode, Soumaya Keynes talks to journalist Amy Goldstein about what the rebound of one town in Wisconsin can tell us about the US economy.

US solar research: First Solar, America’s largest photovoltaics manufacturer, aims to commercialise the next generation of technologies to harness power from the sun before China does.

West Bank lenders: Bank earnings in the Palestinian territory have been hit and theft is rising as Israeli curbs and war fallout leave more than $1bn idling in vaults.

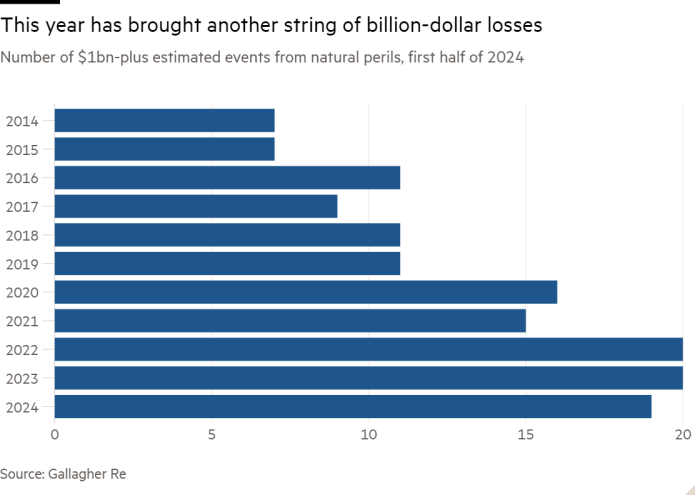

Chart of the day

US home insurers last year suffered their worst underwriting loss this century as a toxic mix of natural disasters, inflation and population growth in at-risk areas put a vital financial market under acute pressure. Insurers providing policies to homeowners suffered a $15.2bn net underwriting loss last year, according to figures from rating agency AM Best, a figure it said was the worst since at least 2000 and more than double the previous year’s losses. Find out more here.

Take a break from the news

Take a break from the news

David Honigmann recounts the rich and enjoyable moments during the world music festival’s first two days. From Tanzanian grooves and Malian funk to Vietnamese ska, Womad brings music from less familiar parts of the world.

The Zawose Queens, from a Tanzanian musical family, drew a large audience at Womad © Womad Festival

The Zawose Queens, from a Tanzanian musical family, drew a large audience at Womad © Womad Festival

Additional contributions from Camille De Guzmán and Benjamin Wilhelm

Recommended newsletters for you

One Must-Read — Remarkable journalism you won’t want to miss. Sign up here

Sort Your Financial Life Out — Learn how to make smarter money decisions and supercharge your personal finances with Claer Barrett. Sign up here

Source link : https://www.ft.com/content/4838068f-4903-48c8-99b0-8e48599e780c

Author :

Publish date : 2024-07-29 06:26:13

Copyright for syndicated content belongs to the linked Source.