The Texas drawl rang out across the airwaves from San Diego to Sacramento: “I hear building a business in California is next to impossible. This is Texas Governor Rick Perry and I have a message for California businesses: come check out Texas.”

Broadcast in February 2013, the radio advert was Perry’s boldest stunt in a campaign to lure companies from the west coast to Texas. Although it was dismissed as “barely a fart” by Jerry Brown, Perry’s Californian counterpart, the following year carmaker Toyota announced it would move its US headquarters from Torrance, California to Plano, Texas.

“That was one of those clarion moments when it’s like: this has worked,” Perry tells the Financial Times. “This is a major world-known entity that is moving out of California, and moving to Texas.”

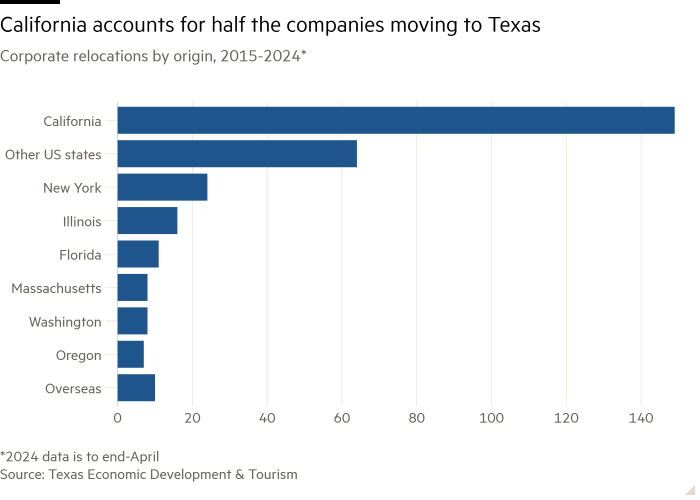

Since then a roll call of California-based corporate giants have followed suit, attracted by the Lone Star State’s hands-off approach to tax and regulation, including Charles Schwab, Oracle, HP, Tesla, CBRE, and Dropbox. Of the roughly 300 corporate arrivals between 2015 and April this year, more than half have been from California.

Last week social media platform X and space explorer SpaceX became the latest defectors. Elon Musk, chief executive of both groups, said California laws on gender identity were “the last straw”.

The new arrivals have helped transform Texas into an economic powerhouse, home to more of the biggest US companies than any other state. If it were a country, Texas would boast the eighth largest economy in the world, ahead of Italy, Canada and Russia. Greg Abbott, who succeeded Perry as governor in 2015, calls the state “America’s economic juggernaut”.

Pitting America’s two biggest states of Democratic California and Republican Texas against each other also reflects the national debate about economic policy — a contrast that will probably be accentuated now that former California senator Kamala Harris is the likely Democratic nominee for president.

Texas is now taking the fight to two other Democrat-dominated states — New York, home to the country’s financial centre, and Delaware, where much of corporate America is legally incorporated.

A Dallas-based national stock exchange was unveiled in June with the goal of challenging the primacy of the NYSE and Nasdaq, while dedicated business courts opening in September aim to convince companies to incorporate in Texas rather than Delaware, as Tesla recently did.

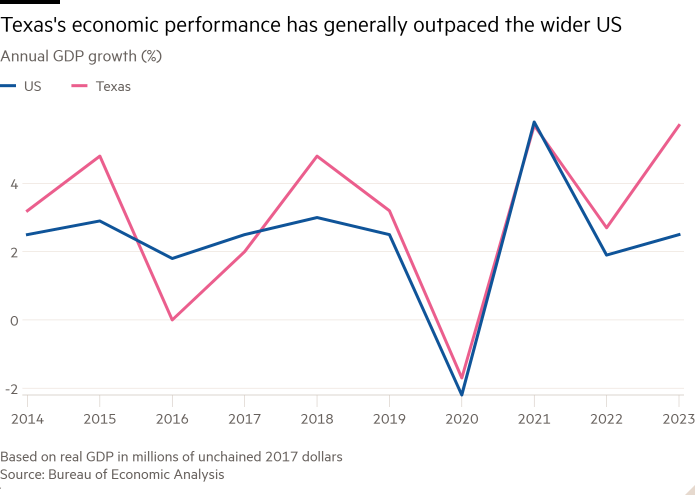

3.0%The average annual growth of the Texas economy over the past 10 years, compared to about 2.3% for the US as a whole

“The economic momentum of Texas is unstoppable,” says Glenn Hamer, head of the Texas Association of Business. “And as we say in Texas: it ain’t braggin’ if it’s true.”

All of this is part of a push to give new impetus to the so-called Texas miracle that has transformed the state in recent years. In the last 10 years its economy has grown by an average 3 per cent annually, compared with about 2.3 per cent for the US as a whole.

The boom has slowed lately, but growth still outstrips the national average. During the first quarter it sat at 2.5 per cent versus a national figure of 1.4 per cent. Pia Orrenius, an economist at the Dallas Federal Reserve, says the state is “coming back to earth” but expects it to continue growing faster than the country.

But the appeal of the Lone Star State is not what it was. Texas infrastructure is creaking under the weight of new arrivals while inflation has eroded some of the state’s low-cost appeal and squeezed locals, many of whom are not feeling the benefits of the surge in high-end jobs.

Infrastructure in Texas is creaking under the weight of new arrivals and many locals feel they are not benefiting from the surge in high-end jobs © Jordan Vonderhaar/Bloomberg

Infrastructure in Texas is creaking under the weight of new arrivals and many locals feel they are not benefiting from the surge in high-end jobs © Jordan Vonderhaar/Bloomberg

Then there’s politics. Critics say that the old-fashioned Republican pitch of fewer regulations and lower taxes has given way to an increasingly intolerant stance on so-called woke issues, mirroring the party’s shift at national level under former president Donald Trump. Executives who have spoken out on such matters have sometimes found themselves slapped down by lawmakers.

“If some of this Maga extreme rightwing social engineering continues from the governor and his Maga cronies in the legislature, we’re going to have a problem,” says Sylvia Garcia, a Democratic congresswoman representing Houston. “Some of those Fortune 500 companies that are based here in Texas are going to leave.”

Texas boasts a self-image of rugged independence and unfettered freedom, a place where people make their own luck and government keeps out of the way.

“The solid rock that Texas built its foundation on economically was: don’t overtax, don’t over-regulate, don’t over-litigate and have a skilled workforce,” says Perry, the former governor. “That’s the foundation — and then we added to it.”

During his 14 years in office, Perry lowered taxes, slashed red tape and overhauled the state’s legal system to reduce frivolous lawsuits. He also established a host of business incentive programmes.

“I felt confident that if we could get people to come to the state of Texas, they could understand that we’re more than just cowboys and wide open spaces and oil jacks going up and down.”

Texas remains America’s biggest producer of oil and gas, but it is now also the top state for wind power and second in solar and semiconductors. Houston, once synonymous with oil, has emerged as a burgeoning cleantech hub.

Under Abbott, the state is looking to reinforce its reputation as a corporate mecca that will not meddle unnecessarily in business affairs. Last year, he signed into law the biggest property tax cut in the state’s history.

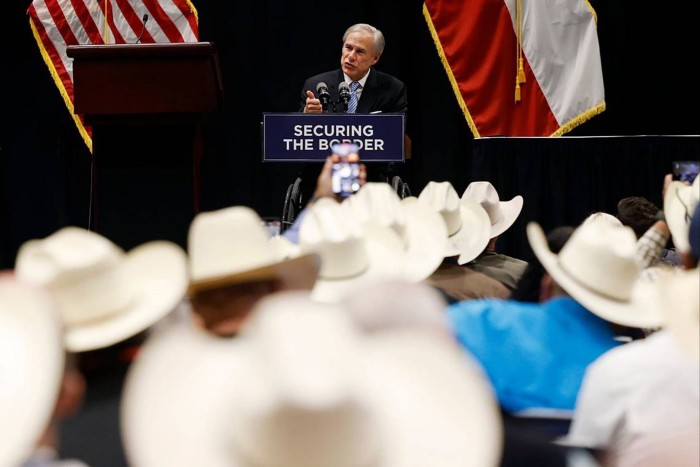

Texas governor Greg Abbott, who has cut swaths of red tape for business, calls the state ‘America’s economic juggernaut’ © Amanda McCoy/TNS/Getty Images

Texas governor Greg Abbott, who has cut swaths of red tape for business, calls the state ‘America’s economic juggernaut’ © Amanda McCoy/TNS/Getty Images

“In Texas, we cut red tape and protect industry from harsh job-killing restrictions and unnecessary regulations that can burden innovators elsewhere,” says Abbott.

The launch of specialist business courts, overseen by a new court of appeals, marks another significant shake-up of the state judicial system. “This is a part of a trend of wanting to make the state more growth oriented,” says Scott Brister, a former Texas supreme court judge who has been appointed chief justice of the new appeals court.

Officials ultimately hope it will help convince companies that the Texas judicial system is just as well equipped to handle complex legal cases as the court of chancery in low-tax Delaware, home to around 70 per cent of Fortune 500 companies.

“I think the business courts are basically adding one element that has been missing,” says Byron Egan, partner at law firm Jackson Walker and an elder statesman of the Texas bar. “The expectation is that as Texas gets to be fully recognised as a better place to be domiciled and doing business, you’ll see more people choose to domicile here.”

If the business courts hope to draw incorporations to the state, the TXSE — which is expected to begin trading next year — is intended to draw capital. It has already secured investment from BlackRock and Citadel Securities.

Its pitch is providing “more stability and predictability around listing standards and associated costs” than the dominant NYSE and Nasdaq. It aims to hoover up listings among the 5,000 plus private equity backed groups in and around the state preparing to go public and snare some of the 1,500 in the region that are already publicly traded.

Less interference is a selling point for both, whether it is the courts seeking to capitalise on anger over perceived judicial over-reach in Delaware or the exchange looking to attract companies chafing at Nasdaq’s controversial diversity quotas.

If it is successful, the exchange will help boost the appeal of Dallas, America’s second-biggest financial hub, as it vies to lure business from New York. The city has already attracted large numbers of financial professionals, whose numbers have grown almost 50 per cent from pre-pandemic levels, according to Ray Perryman, a prominent Texas economist.

“New York City will remain the perceived financial sector capital for the time being,” says Perryman. “Unless something significant changes, however, the gap between New York City and Dallas will continue to narrow and, eventually, disappear.”

But the impressive growth in job numbers and GDP masks a darker side to the Texas boom, argue Democrats, who say the state’s hands-off, low-tax approach has left many locals behind.

“Your average corporate headquarters downtown and many of your chambers will say it’s a boom. But it’s a bust when it comes to human capital,” says Garcia. “Growth has been on the backs of low-wage workers.”

In stark contrast to its corporate podium spots, Texas ranks in the bottom 10 US states for educational attainment, has the highest proportion of people with no health insurance and among the highest rates of child poverty, at about 20 per cent.

“That’s one out of five kids in this state living in poverty,” says Garcia. “And we want to brag that we’re a great state for business?”

20%The rate of child poverty in Texas, ranking among the highest in the US

For many Texans, the malaise has deepened as a result of the influx of companies and employees. Austin, the state capital, has been transformed from a midsized hippy town to a tech hub. But its population grew by almost half between 2000 and 2020, its infrastructure is struggling to cope and surging costs have priced out some locals.

Some companies are moving out of Texas. Tech giant Oracle, one of the state’s biggest prizes when it relocated from Silicon Valley in 2021, now plans to make Nashville, Tennessee its global headquarters. Although co-founder Larry Ellison said this was in order to be closer to its healthcare customers, the high-profile nature of its defection has raised questions about whether Texas is losing its competitive edge.

“The juice isn’t worth the squeeze [any more],” says Joah Spearman, a tech entrepreneur who left Austin last August for Sacramento after 14 years in the city. “The juice of Austin used to be that vibrant, creative, culturally rich energy.”

But now, he says, a combination of populist state politics and rampant cost increases “creates this situation in which people are like: ‘Man, so many of the things that I like about Austin can be found in other places’.”

There are also questions over the sustainability of the population growth. Last month Ercot, the state grid operator, suggested Texas’s power demand could double by 2030, as data centres used for artificial intelligence add to consumption.

One Republican state senator wondered aloud whether Texas should consider blocking power-hungry new corporate arrivals. Separately, political squabbling allowed a 20-year-old economic incentive programme to expire in late 2022, to the dismay of the business community. Replacement legislation was passed six months later.

The population of Austin grew by almost half between 2000 and 2020, its infrastructure is struggling to cope and surging costs have priced out some locals © Jordan Vonderhaar/Bloomberg

The population of Austin grew by almost half between 2000 and 2020, its infrastructure is struggling to cope and surging costs have priced out some locals © Jordan Vonderhaar/Bloomberg

The cooler reception towards business has frustrated some local Republicans, who worry the state is moving away from the ethos that made it such a magnet for relocations.

“Texas Republicans are not, in my opinion, as reliably pro-business as they have been over the last few decades,” notes one long standing GOP operative in the state. “While I still think that is a minority view, it is troubling to me.”

Texas’s increasingly socially conservative tilt has also raised tensions with business, as moderate politicians have been pushed out in favour of more populist, pro-Trump candidates.

The state outlawed abortion in almost all cases in 2022 and has also taken a conservative line on LGBT issues, attempting to ban some drag shows and placing restrictions on transgender athletes. The 141 pieces of LGBT-related legislation introduced in the state account for a fifth of the total such bills in the US last year, according to the Human Rights Campaign, an NGO.

Where businesses have spoken out, they have often been met with fierce blowback from the state’s political leadership. “Stay out of things you don’t know anything about,” lieutenant-governor Dan Patrick thundered at American Airlines amid a row over new voting rules in 2021. “Don’t, on one hand, say ‘Thank you Texas’ while on the other hand slap us in the face. We’re not going to put up with it any more.”

Demonstrators march in Houston in 2021 to protest the controversial state bill that became law in 2022, outlawing abortion in almost all cases © Reginald Mathalone/NurPhoto/Reuters

Demonstrators march in Houston in 2021 to protest the controversial state bill that became law in 2022, outlawing abortion in almost all cases © Reginald Mathalone/NurPhoto/Reuters

Critics say this more confrontational approach represents a shift away from the hands-off attitude upon which the state has built its corporate allure.

“Basically, they told the business community to step away from the conversation around social issues,” says Steven Pedigo, head of the LBJ Urban Lab at the University of Texas at Austin and an expert in urban economic development.

“It is so unlike Texas, and what has been the message around economic development in Texas for a long time: we have been laissez faire, libertarian, come start your business, come invest, do whatever the hell you want to do,” he adds. “And I think that message is getting locked up.”

Unafraid to throw around its economic heft, the state has introduced a series of blacklists of “woke” investors it will not do business with if they are perceived to boycott industries like fossil fuels or firearms.

BlackRock, the giant asset manager, has found itself in the state’s crosshairs. After it was placed on a list of asset managers alleged to have boycotted the oil and gas industry, a state fund pulled $8.5bn of assets in March. The fund manager denied it had discriminated against fossil fuel companies and said the move “put short-term politics over . . . long-term fiduciary responsibilities”.

While Texas remains America’s biggest producer of oil and gas, it is also home to a burgeoning tech hub © Dylan Hollingsworth/Bloomberg

While Texas remains America’s biggest producer of oil and gas, it is also home to a burgeoning tech hub © Dylan Hollingsworth/Bloomberg

Perry concedes there is “a little more friction . . . with the current leadership in the state of Texas and the business community”.

“I think this is because the business community has come in and tried to push some things into Texas,” he adds “But don’t get confused here, Mr CEO. This isn’t New York, this isn’t California, this is Texas . . . and if you want to do business here, here’s our parameters.”

Abbott dismisses concerns that the friction could undermine the state’s corporate appeal, noting that the arrivals are continuing. Texas’s population hit 30.5mn last year, up by about 10mn since 2000.

“People and businesses vote with their feet,” says Abbott. “And continually they are choosing to move to Texas more than any other state.”

Source link : https://www.ft.com/content/ccb78b87-e572-4420-b432-3a7726e1aed8

Author :

Publish date : 2024-07-25 00:01:54

Copyright for syndicated content belongs to the linked Source.